I've just found myself engaged in an interesting conversation over at LinkedIn concerning the oft posed question that:

There appears to be a high variance for order throughput times [when using] QuickFIX[/J]

The LMAX multilateral trading facility is written 100% in Java, and here's a presentation that I attended last year given by their then chief technology officer Martin Thompson:

Martin discusses much of the "folklore" concerning what's involved in persuading Java to trade at an ultra high frequency, and at around 16:40 he observes that:

If you try to get anywhere near 39,000 price updates a second through QuickFIX/J I'd love to see the processor you pick to do it on. It's a great FIX engine, it's reliable, it's reasonably stable, it generates a huge amount of garbage and it does horrendous things from a performance perspective. Have a look at the code for how it parses an integer.

Your application may well not be as demanding as an MTF, but what's your experience with QuickFIX/J? Are you impressed by its reliability and stability, or are you frustrated by its inconsistent latency and therefore willing to pay good money to get greater consistency?

Filed under Trading Platforms by ![]()

Fresh from prosecuting and fining a range of foreign exchange brokers the CFTC have now started to fry some bigger fish. Referring to a by now familiar misuse of supposedly segregated funds, and using a by now familiar form of words, they just announced that they have:

Filed and simultaneously settled charges against JPMorgan Chase Bank, N.A. (JPMorgan) for its unlawful handling of Lehman Brothers, Inc.’s (LBI) customer segregated funds.

Do you remember Lehman Brothers? It seems that the CFTC:

Finds that from at least November 2006 to September 2008, JPMorgan was a depository institution serving LBI, a futures commission merchant (FCM) registered with the CFTC. During this time, LBI deposited its customers’ segregated funds with JPMorgan in large amounts that varied in size, but almost always more than $250 million at any one time.

During the same time period, JPMorgan extended intra-day credit to LBI on a daily basis to facilitate LBI’s proprietary transactions, including repurchase agreements, or “repos.” JPMorgan would extend intra-day credit to LBI to the extent that LBI’s “net free equity” at JPMorgan was positive. As of November 17, 2006, JPMorgan included LBI’s customer segregated funds in its calculation of LBI’s net free equity, even though these funds belonged to LBI’s customers

This sort of behaviour is prohibited by the Commodity Exchange Act (CEA) but it happened anyway, so:

The CFTC order imposes a $20 million civil monetary penalty against JPMorgan. The order also requires JPMorgan to implement undertakings to ensure the proper handling of customer segregated funds in the future and to release customer funds upon notice and instruction from the CFTC.

In another announcement earlier this week the CFTC filed, but just for a change didn't settle, charges against:

The Royal Bank of Canada (RBC), a Canadian bank and financial services firm doing business in New York, with conducting a multi-hundred million dollar wash sale scheme in connection with exchange-traded stock futures contracts.

In this case it seems that the Royal Bank of Canada is going to contest the CFTC allegations that:

From at least June 2007 to May 2010, RBC allegedly non-competitively traded hundreds of millions of dollars’ worth of narrow based stock index futures (NBI) and single stock futures (SSF) contracts with two of its subsidiaries that RBC reported as “block” trades on OneChicago. The CFTC’s complaint alleges that RBC’s NBI and SSF trading activity, which accounted for the majority of OneChicago’s volume during the relevant period, constituted unlawful non-competitive trades, wash sales and fictitious sales.

I wonder what other tricks the CFTC might have up its sleeve, particularly with elections on the horizon in the not too distant future? They themselves put it this way:

Today’s action should make clear that the CFTC will not hesitate to bring charges against even the most sophisticated market participants who unlawfully exploit the futures markets for their own gain.

Filed under Regulation by ![]()

WorldSpreads are (or perhaps I should say were?) an AIM listed spread betting broker, famous in this part of the world for offering "zero spreads" on some popular instruments as long as you sent them £5000 up front. This morning their website has taken on a whole new look. After an obviously hasty redesign over the weekend it now says:

Upon the application of the directors of WorldSpreads Limited, the High Court has today appointed Jane Moriarty and Samantha Bewick of KPMG LLP as joint special administrators of WorldSpreads Limited, under the Special Administration Regime (SAR). WorldSpreads Limited is a wholly owned subsidiary of WorldSpreads plc, a company incorporated in Dublin, Ireland.

The administration of Worldspreads Limited follows the discovery of accounting regularities which the company became aware of during the course of Friday 16 March 2012. Following this it quickly became apparent that there was a shortfall in client monies and the directors and their advisors concluded that the best course of action, in order to mitigate losses for clients, would be to place the company into special administration.

In events rather reminiscent of the MF Global fiasco, albeit on a smaller scale, it now seems as though it might take quite a while for WorldSpreads customers to be able to withdraw any money from their accounts. We will watch with interest to see whether British and Irish law is any more effective at returning supposedly "segregated" funds to their rightful owners than United States law has thus far proved to be.

I wonder how much will be left in the pot after the special administrators and other legal eagles have taken their cut, and how much the Financial Services Compensation Scheme (FSCS for short) will eventually cough up. According to The Financial Services Authority (FSA for short):

The joint special administrators will review the client cash holdings positions and will return as much cash as possible directly to each client as soon as practicable. However, clients should be aware that any shortfall in the client money accounts will impact the amount of money that can be returned.

Depending on individual circumstances customers may have access to the Financial Services Compensation Scheme (FSCS) should there be any losses. Customers should contact the special administrators to understand more about implications for them personally.

Customers of WorldSpreads should contact the joint special administrators for more information on 020 3284 8829.

Filed under Brokers by ![]()

We've previously discussed a variety of academic and political views on the costs and/or benefits of high frequency trading here on the Trading Gurus blog. If that type of thing is of interest to you as well then you might want to wander over to The Economist, where a "virtual debate" is currently taking place on the topic of "This house believes that high-frequency trading contributes to the overall quality of markets".

Proposing that motion is Jim Overdahl, currently vice-president of the Securities and Finance Practice, National Economic Research Associates, and ex SEC and CFTC. His opponent in the debate is Seth Merrin, serial entrepreneur and currently CEO of Liquidnet. As some commentators over at the Economist have pointed out, these guys might not be entirely unbiased! Despite that I'm finding the discussion very interesting, with lots of links to learned economists' findings that support both sides of the argument. There are also lots of pertinent views being expressed from practitioners on the "virtual floor". Here's a few snippets to give you a flavour. For some reason the guys at the front seem to be much more focussed on stocks rather than commodity futures, so firstly lets hear from a "hedger" in the agricultural markets, who seems to be anti HFT:

When a farmer hedges the fall soybean crop, the slippage or range of hedging prices has almost doubled to what it was five years ago. The HFT markets has scared a lot of REAL users OUT of the market place.

On the other side of the fence here's someone who sounds like he's an "investor" in stocks:

If you think about how stock trading was done 10-20 years ago by banks over the phone, and later through internet brokers and public exchanges, you'll see that a typical HFT earns much less than the fat fees banks used to charge or fees a typical internet broker charges. Today's markets are much more transparent and efficient thanks to computer automation and HFTs. I believe nobody should expect us to go back to the 'stone age' days of trading.

The Economist's debate still has a few days to run, with the closing arguments being put forward next week. Currently the voting is 42% in agreement with the motion, and 58% against. However that vote finishes up, I feel sure that this one is going to run and run. Politicians and regulators will ultimately have much more to say on the issue than even The Economist and its readers.

Filed under Regulation by ![]()

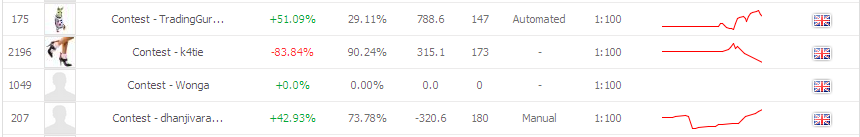

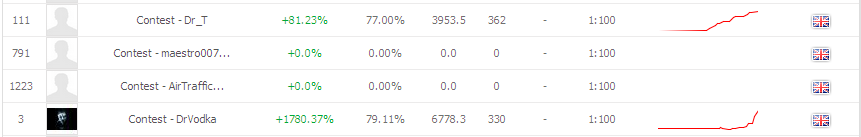

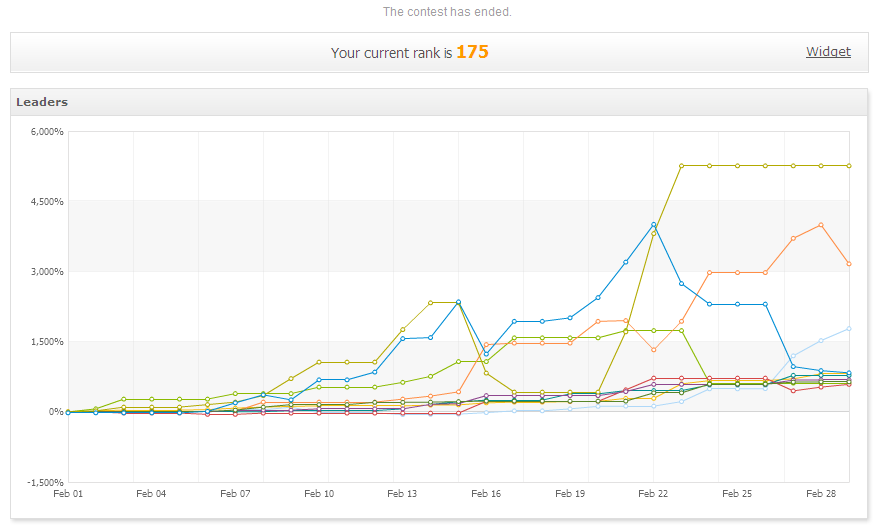

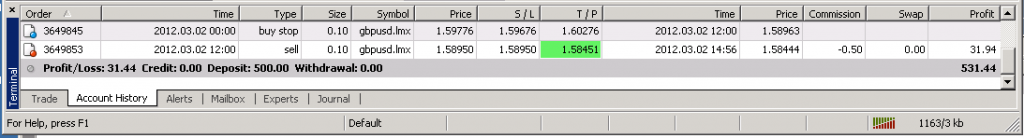

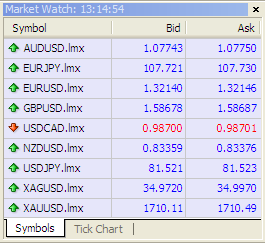

Ray Robot II™ has now been running his live spread betting test comparing Alpari UK with GKFX for over a month. We're rather obsessive here at the Trading Gurus, and we've noticed a variety of interesting differences between Ray's four experimental accounts during that time. Some observers have however suggested to us that all that matters in a trading account is "the bottom line". Whilst we humbly disagree with that assertion, Ray is nonetheless now proud to announce that there is at last a difference between the bottom line of his Alpari accounts (currently standing at £255.00) and his GKFX accounts (currently standing at £261.00). There are any number of other (less significant?) differences also.

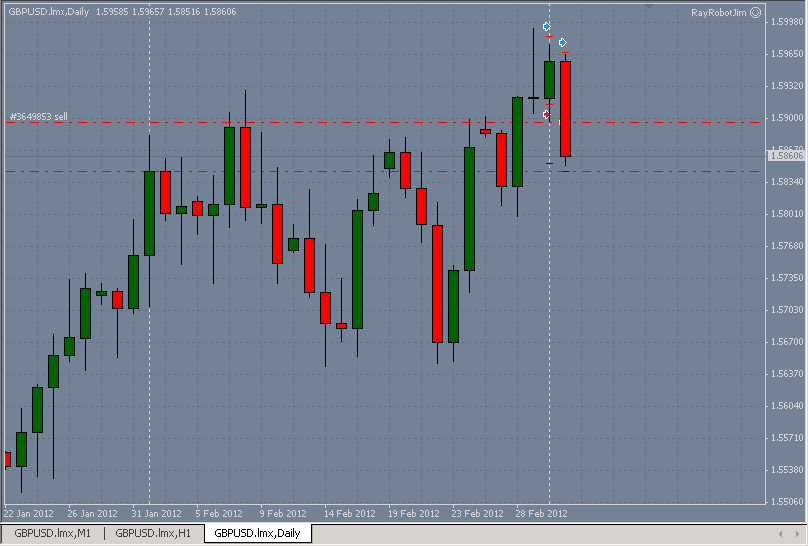

Let's first of all compare equity curves for Ray's live accounts. Here's how his Alpari UK spread betting account looks this morning:

According to myfxbook the bottom line of £255 can be characterised by a "Profit Factor" of 1.25 following a "Drawdown" of 3.85%. Now here's Ray's GKFX equity curve:

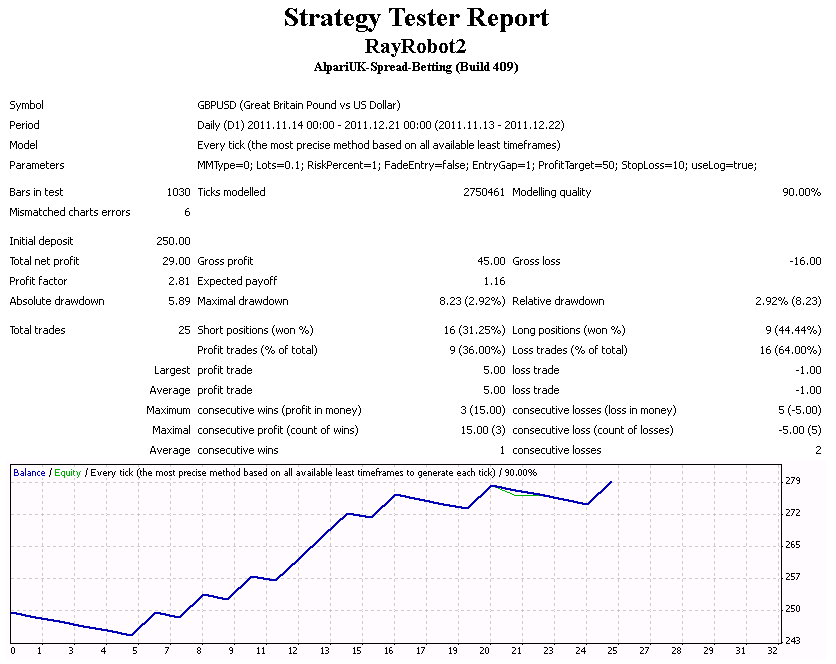

According to myfxbook once more this time around Ray's profit factor is 1.58 after a drawdown of 3.46%. Here's a funny thing though. If you look at Ray's trading accounts at Forex Factory instead of at myfxbook the drawdown numbers are slightly different. Here's another funny thing too. This morning I ran some backtests on the same two accounts, on the same VPS, over the same period of time. Here's what the MetaTrader 4 strategy tester showed me, first for Alpari:

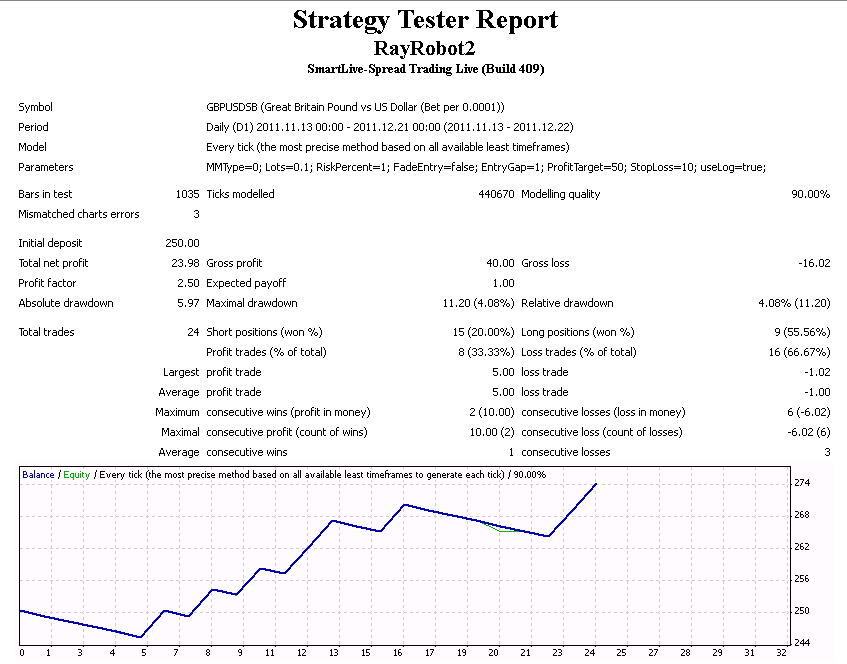

As you can see, in backtests Alpari's version of MetaTrader reports a profit factor of 2.81 following a drawdown of 2.92%. Taking a look at GKFX instead:

As you can see, we have yet another different equity curve, and another set of numbers. This time we're told the profit factor is 2.50 and the drawdown is 4.08%.

Here's an entertaining game for any interested readers to play over the Christmas holiday season. Which of all those different sets of results do you think best represents Ray's future performance trading cable in the New Year? Finally, if you should happen to have some spare cash left over after doing all your Xmas shopping, on the evidence Ray has accumulated so far in his testing would you prefer to open a spread betting account with Alpari UK or GKFX?

Filed under Brokers by ![]()