Regular readers of the Trading Gurus blog will be aware that we have been pondering the possible effects of additional regulation on markets on both sides of the Atlantic for some considerable time now. In this guest post Alex Krishtop of Edgesense Solutions speculates about what the future holds for the world's financial markets. In our view Alex's crystal ball is much clearer than those of the vast majority of market commentators.

For more than a year regulators on the both sides of Atlantic have been working hard applying new restrictions to many different markets. The swaps market was possibly the first to undergo major changes. Then followed other derivatives and most OTC markets in general. Attacks on HFT are another substantial segment of modern regulatory activity. The spot FX market was also not left untouched: severe restrictions on banks’ prop activity have already caused a serious restructuring of the whole business and generated a great number of job seekers, but with the most recent proposals by the Financial Stability Board it’s now not unlikely that a centralized clearing facility will be established for this largest OTC market (so far).

What are the consequences of all this unprecedented activity and who are its real beneficiaries?

The average Joe might think that all these measures are indeed intended to reduce “market manipulation” and therefore to “protect” something, his pension savings for example. Probably this is the official decoration for all these processes. We should note here that the chances are, though, that the average Joe won’t ever understand what this campaign is all about. However he doesn’t need to.

Looking at these processes more critically one could easily note that all of them imply greater centralization of all markets and an increasing role for the exchanges and central clearing houses (and similar centralised structures). Therefore the regulatory process probably serves the interests of the exchanges and large brokers. As an immediate effect it causes increased expenses (considering just the new reporting requirements — not every institution would be able to afford it!), and as a consequence — increased transactional costs, at least for most trading venues. As the result, only the really big players in this market will be able to afford to conform to the new rules of the game. Therefore their importance will increase further while minor market participants are likely to further lose their share.

Now what is there in this analysis that could be useful for market speculators? Presently the market is right in the middle of the process of restructuring, and when this process is over we will see a completely new world. The fact that the market is currently in transition is most likely the very reason for the unprecedentedly low volatility, and understanding this reason helps one to estimate how long it might last. With the increased transactional costs we can expect the “come-back” of trading in underlying instruments instead of derivatives, with possible a greater focus on commodities. Besides that the new environment may significantly diminish the reward/risk ratio for many (if not most) short-term and ultra-short-term strategies, along with “market neutral” strategies. In other words, everything that used to generate 20% annual profits with virtually zero risk (“a new standard”, as one of my friends said) might well be rendered useless.

However the most likely and most influential outcome of the whole process will be dramatic reduction of liquidity in all markets, but especially in FX, that will lead to increased volatility and in general a result that is diametrically opposed to that declared by the regulators. Then we might expect the volatility-based alpha-generating strategies to celebrate the “great come-back”.

It’s especially interesting that the end of restructuring of markets will most likely coincide with the end of tapering, QE and ZIRP. This may lead to even more interesting market phenomena.

In conclusion, please don’t throw away your old breakout strategies just yet!

Filed under Guest Posts by ![]()

Interactive Brokers have recently released build 944 of their venerable Trader Workstation platform (or TWS for short). They have also made the interesting announcement that:

MultiCharts advanced charting is now accessible from within TWS as a complement/upgrade to our existing interactive charts.

Multicharts.net

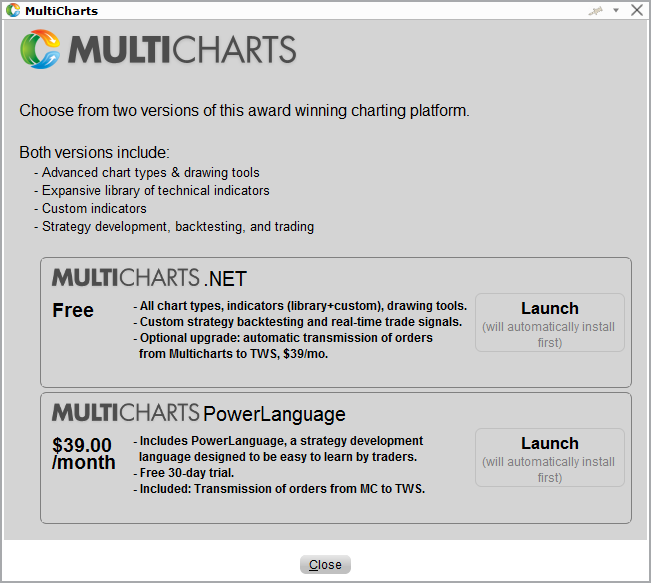

The MultiCharts.net tool is available free of charge to IB customers (does not include the ability to trade) and includes:

- Advanced charting

- Drawing tools and a large library of more than 300 indicators

- User-programmable technical indicators

- Strategy backtesting

- User-programmable trading strategy signals

User-programmable features can be programmed using C# or Visual Basic. To trade from within MultiCharts.net, upgrade for $39.00 per month (following a one-month free trial).

MultiCharts PowerLanguage

Customers who want to trade from within MultiCharts AND who need to program complex custom technical indicators but are not programmers can subscribe to MultiCharts PowerLanguage. This version offers all of the charting features of MultiCharts.net plus the ability to trade, and the addition of PowerLanguage, a more user-friendly computer programming language with a small learning curve that was designed to be used by non-programmers. The PowerLanguage version is available for $39.00 per month (following a one-month free trial).

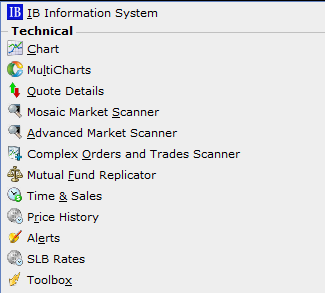

To summarise, as long as you have an account with Interactive Brokers and you don't object to running Trader Workstation on Windows instead of Linux you can now perform backtesting using the .NET version of MultiCharts at no extra charge. If you want to auto-trade with IB using either the .NET or Power Language flavours of MultiCharts you can do so for an additional $39 per month. Unable to resist the temptation I found the new "MultiCharts" option in the TWS "Analytical Tools" menu:

When I clicked it I was offered a choice of which flavour of MultiCharts to download:

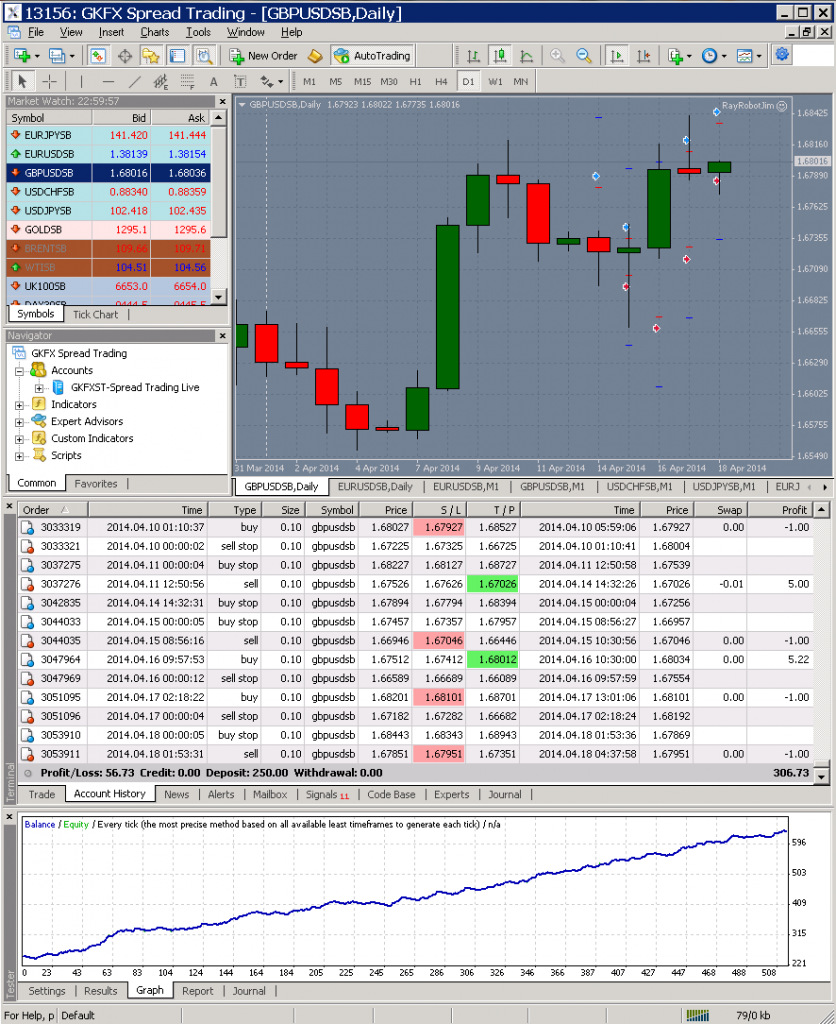

Being a cheapskate I went for the TWS special edition of MC.NET and once everything was installed I tried backtesting Ray the Random Robot, only to be greeted with a very familiar sight:

Unfortunately even if MultiCharts is now more tightly integrated with Trader Workstation it's still a long job trying to download enough historical data to perform a backtest that uses more than a few days worth of one minute bars. Even if that sadly all too familiar message is still there, many other things are not. With the free of charge version of TWS MultiCharts there is no separate Quote Manager, there is no Portfolio Backtester and there are no 3D Optimization Charts. However there is at least a backtester now available bundled with TWS.

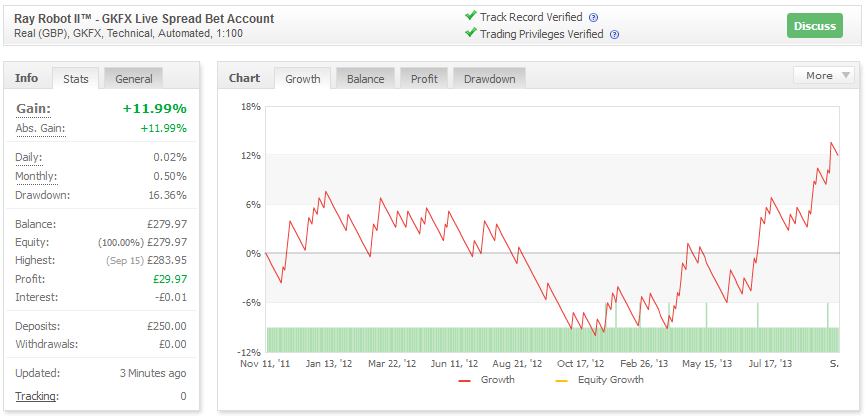

As a consequence another thing has just been added to our to do list. We'll now have to try out Ray Robot Junior with the MultiCharts.NET backtester to see if it is up to the job of producing some results that even vaguely resemble what Ray has managed to achieve in live trading!

Filed under Trading Platforms by ![]()

In a press release today FXCM have announced that:

Its U.K. subsidiaries, Forex Capital Markets Limited and FXCM Securities Limited, [have] entered into a settlement with the Financial Conduct Authority (“FCA”). The settlement addresses trade execution practices concerning the handling of price improvements on FXCM UK’s offsetting orders from August 2006 – December 2010.

Under the terms of the settlement, FXCM UK has agreed to pay fines totaling £4 million to the FCA and to provide approximately $10 million in restitution to the affected clients. FXCM recorded a reserve $15 million in the third quarter of 2013 for this matter and will record an additional $1.9 in the fourth quarter to reflect the terms of the settlement and related expenses. All clients receiving restitution will be notified within 60 days. Of the approximately $10 million being credited under this settlement, the impact on individual traders was typically very limited and averaged $3.70.

Unfortunately it doesn't sound like I'll be receiving a massive windfall any day soon! The FCA themselves have also issued a press release about the matter today, with a somewhat different emphasis to FXCM's. The FCA says that:

The Financial Conduct Authority (FCA) has fined Forex Capital Markets Ltd and FXCM Securities Ltd £4,000,000 for allowing the US based FXCM Group to withhold profits worth approximately £6 million ($9,941,970) that should have been passed on to FXCM UK’s clients.

FXCM UK also failed to tell the FCA that the US authorities were investigating another part of the FXCM Group for the same misconduct. The FCA has ensured that FXCM UK’s clients will be fully compensated, with credit automatically paid to their accounts.

According to Tracey McDermott, the FCA’s director of enforcement and financial crime:

Not only did FXCM UK fail to treat its customers fairly or correctly apply our rules, I am particularly disappointed that it was not transparent in its dealings with the FCA. We expect all firms to put customers at the heart of their business, and we have taken action to ensure clients of FXCM UK will get redress.

The FCA press release goes on to provide more details about FXCM UK's failure to treat its customers fairly, explaining that:

Between August 2006 and December 2010, the FXCM Group kept profits from favourable market movements between the time the orders were placed by FXCM UK and executed by the FXCM Group, while any losses were passed on to clients in full – a practice known as asymmetric price slippage.

As both FXCM and the FCA are at pains to point out, here in the UK at least there are rules about "best execution" that brokers are supposed to adhere to:

Brokers in certain markets, including regulated CFD and spread-bet firms and those offering Rolling Spot Forex contracts for difference, may be failing to recognise that their activities fall within the scope of the best execution rules.

Do you suppose that all those UK regulated CFD, spread-bet and FX brokers will now hastily correct any such failures?

Filed under Regulation by ![]()

Although the Current Employment Statistics section of the United States Bureau of Labor Statistics still says:

The Employment Situation for September 2013 is scheduled to be released on October 4, 2013, at 8:30 A.M. Eastern Time.

the BLS home page currently displays this notice:

This website is currently not being updated due to the suspension of Federal government services. The last update to the site was Monday, September 30. During the shutdown period BLS will not collect data, issue reports, or respond to public inquiries. Updates to the site will start again when the Federal government resumes operations. Revised schedules will be issued as they become available.

Please visit www.opm.gov for the most recent information on Federal government suspensions, shutdowns, and closings.

It looks like tomorrow's anticipated release of the September NFP numbers will not now take place. It also looks like even Barack Obama doesn't know when everyone will be back at their desks at the BLS, and hence when their "revised schedules" might be made available. The Office of Personnel Management web site is currently showing a message from the President "to the dedicated and hard-working employees of the United States Government" dated October 1st 2013, in which he says:

The Federal Government is America's largest employer, with more than 2 million civilian workers and 1.4 million active duty military who serve in all 50 States and around the world. But Congress has failed to meet its responsibility to pass a budget before the fiscal year that begins today. And that means much of our Government must shut down effective today.

This shutdown was completely preventable. It should not have happened. And the House of Representatives can end it as soon as it follows the Senate's lead, and funds your work in the United States Government without trying to attach highly controversial and partisan measures in

the process.Hopefully, we will resolve this quickly. In the meantime, I want you to know-whether you are a young person who just joined public service because you want to make a difference, or a career employee who has dedicated your life to that pursuit-you and your families remain at the front of my mind.

Hope springs eternal, but it doesn't actually pay anybody's bills. According to the August statistics available for download from the US Treasury Direct web site, the United States total public debt outstanding on August 31st was 16,738,650 million dollars.

Filed under Economics by ![]()