Earlier today I virtually attended the FIX Trading Community's webinar on the topic of "Using FIX Orchestra", presented by Jim Northey and Don Mendelson and moderated by Maria Netley. More later, once I've managed to check my notes and write things up at length. For now though, here's FIX Orchestra 101 as a sequence of live "Tweets":

Filed under Technology by ![]()

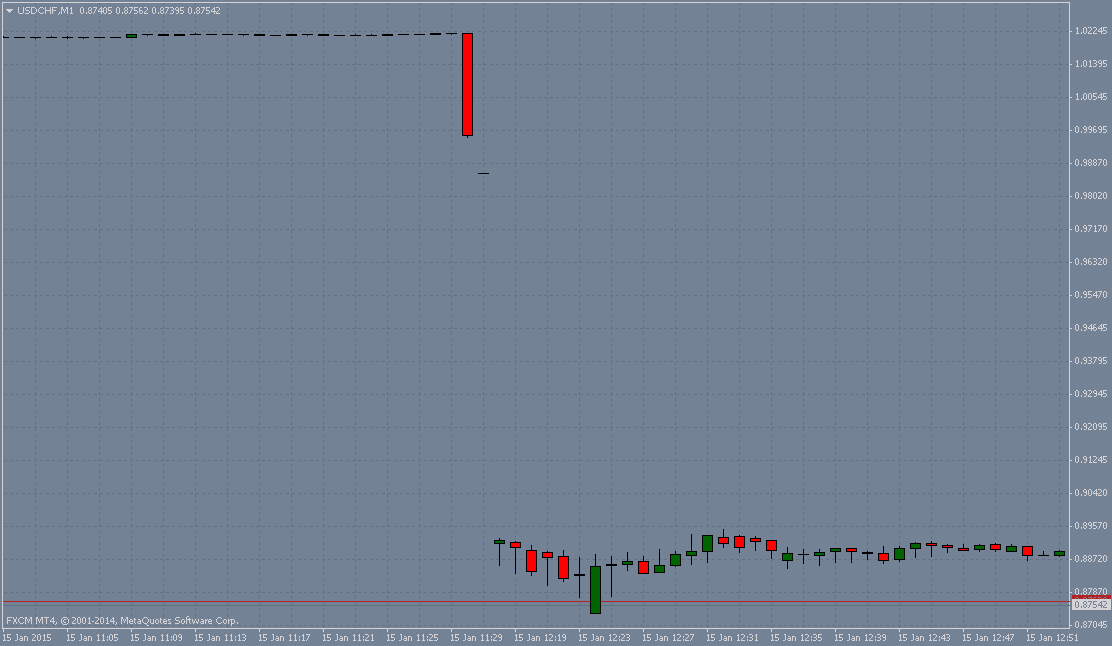

I awoke this morning to a big "blip" on my GBP/USD chart:

During two chaotic minutes of Asian trading, the pound plunged the most since the Brexit referendum in June, with traders saying computer-initiated sell orders exacerbated the slump.

The 6.1 percent drop drove sterling to a 31-year low of $1.1841, according to composite prices compiled by Bloomberg of contributions from dealers. Traders speculated the crash might have been sparked by human error, or a so-called “fat finger,” with algorithms adding to selling pressure at a time of day when liquidity is relatively low.

While the currency snapped back in Asia, it resumed its freefall during European hours, as concern welled up that Britain is headed for a so-called hard Brexit that would restrict its access to the European Union’s single market in return for gaining control of immigration.

In another Bloomberg story there's much discussion about the causes of the latest "flash crash":

together with the news that:

Bank of England Governor Mark Carney has asked the Bank for International Settlements to look into the pound’s sharp drop in trading overnight, which sent the currency to a 31-year low.

Speaking to journalists in Washington on Friday while attending the annual International Monetary Fund meeting, Carney said the BIS’s Markets Committee will look into the flash crash. Earlier, the BOE had said it was looking into the reasons behind the drop.

Was Brexit to blame? A "fat finger"? Or HFT algos? Watch this space and we'll let you know what conclusions the BoE comes to, but please don't hold your breath!

Filed under Regulation by ![]()

I made my annual pilgrimage to the City of London earlier this week, in order to attend the 2016 FIX Protocol EMEA Trading Conference at Old Billingsgate. The first thing on my agenda was the keynote speech by Vince Cable, who according to his billing:

Served as Secretary of State for Business, Innovation and Skills in the Conservative/Liberal Democrat coalition government. He served in the post for five years, before which he was Lib Dem Shadow Chancellor.

Vince's speech wasn't very optimistic about UK Plc's economic prospects, or indeed the probability that we will still be "In Europe" by the end of our summer holidays. There's already a report from Global Treasury Intelligence that's far more comprehensive than my hastily scribbled notes, so quoting from there:

The possibility of British voters supporting the UK’s exit from the European Union in this summer’s referendum, which once seemed remote, has grown to as much as 40% in the assessment of Vince Cable.

He said that stagnation and possible eurozone deflation, plus the “crazy world” of negative interest rates, were risks matched by the Chinese slowdown and political instability. The latter could lead to the EU undergoing a ‘Brexit’ and Donald Trump becoming US president.

Getting more specific about those currently "crazy interest rates", Vince continued:

Volatility on the financial markets – as seen in China since last June – and the slowdown in emerging markets also pose serious threats to the world economy, warned Cable. He told the audience of his concerns that the “very abnormal”, “emergency” and “unorthodox” policies of low interest rates and quantitative easing adopted since the 2008 financial crash were “running out of effectiveness” while economies are slowing down simultaneously.

The big risk is that the West could be on the brink of a sustained period of low or zero growth – as has persisted for more than three decades in Japan.

“You are now seeing desperate measures in Europe too, like negative interest rates to stave off the threat of deflation, which is disastrous for economies as companies stop investing. I’m not predicting doom, but we do need to identify the risks.”

What are "the risks" you may well be wondering. After all is said and done, I thought many traders quite liked "volatility on the financial markets"! Vince's bullet points were:

- The developed world suffering slow growth and possible recession, as EMs also slow down.

- Instability in the financial system and concern about whether the new regulatory measures post-2008 crash will work.

- Global trade wars, which could break out as cooperation between countries breaks down and an anti-‘politics as usual’ mood asserts itself.

Click through to GTNews to get more detail on what sounded to me a lot like much more "doom & gloom" from Vince!

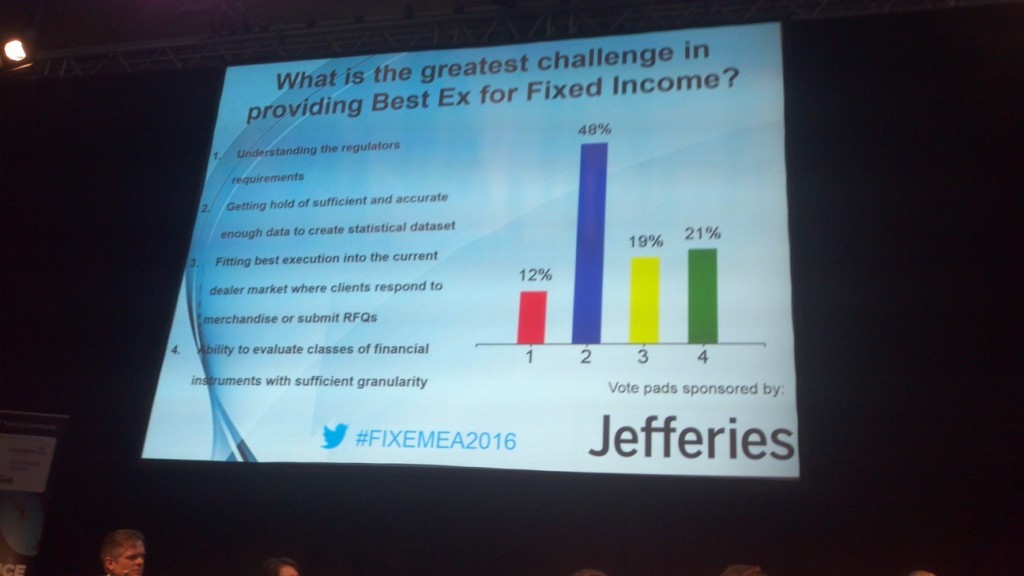

Next up was a presentation by Edwin Schooling Latter from the FCA on "Best execution under MiFID II", subtitled "The Exocet is Coming"!

According to Edwin at least, High Frequency Trading isn't necessarily a bad thing:

High frequency market makers don't have deep balance sheets, but pre-electronic market makers took long coffee breaks! In normal market conditions HFT market makers provide a valuable service, but during "episodes of stress" they tend to "run for the hills" when liquidity is most needed.

After the opening debates I headed straight for the FIX "technical stream" of seminars. Here's a few snapshots from the Trading Gurus Twitter feed:

There was no getting away from #MiFID2 at #FIXEMEA2016, even on the technical stream! Hanno Klein of @DeutscheBoerse pic.twitter.com/0ZEhsuywdF

— Trading Gurus Ltd. (@TradingGurus) March 4, 2016

Marc Berthoud & Matt Bumstead explain to #FIXEMEA2016 how #MMT can help rid charts of strange spikes! @FIXTrading pic.twitter.com/Qapc18ZOiB

— Trading Gurus Ltd. (@TradingGurus) March 4, 2016

Jim Northey explains how to pronounce @Itiviti_AB at #FIXEMEA2016. He also said that @FIXTrading is now on @github pic.twitter.com/CRTFZV6svq

— Trading Gurus Ltd. (@TradingGurus) March 4, 2016

According to Jim Northey, Co-Chair of the FIX Protocol High Performance Working Group, the new name for what was CameronTec is designed to conjure up concepts such as "activity" and "productivity" in the field of "IT". I'm ashamed to admit that's not the first image that my own mind conjured up! Jim also pointed out to the assembled throng that a reference implementation of the new FIX performance session layer (FIXP for short) written in Java is now available on GitHub.

The #FIXEMEA2016 #blockchain panel. Nick Williamson of @CreditsVision, Anthony Macey & @peter_c_randall of @setl_io pic.twitter.com/gJr21R5KRw

— Trading Gurus Ltd. (@TradingGurus) March 4, 2016

After all that excitement it was a pleasure to be able to find somebody who wanted to discuss trading instead of MiFID II at the post conference cocktail party. Here's the view out of the Old Billingsgate window:

and here's who I shared a glass or two of red wine with:

..DtBkPharmaCo UbsRuCo GabEnvt

-UK • https://t.co/OL0DMxP12J https://t.co/wKLUL6fKFw https://t.co/OUoZab6j6Z https://t.co/pxby6NNAkG ..— HEDG€FUND⚡️$TRAT£G¥! (@CFAMBAibk) March 3, 2016

Now all I need is somebody to explain Mike's "Tweets" to me!

Filed under Technology by ![]()

In a press release dated April 21st 2015 the US Commodity Futures Trading Commission announced:

The unsealing of a civil enforcement action in the U.S. District Court for the Northern District of Illinois against Nav Sarao Futures Limited PLC (Sarao Futures) and Navinder Singh Sarao (Sarao) (collectively, Defendants). The CFTC Complaint charges the Defendants with unlawfully manipulating, attempting to manipulate, and spoofing — all with regard to the E-mini S&P 500 near month futures contract (E-mini S&P). The Complaint had been filed under seal on April 17, 2015 and kept sealed until today’s arrest of Sarao by British authorities acting at the request of the U.S. Department of Justice (DOJ). After the arrest, the DOJ unsealed its own criminal Complaint charging Sarao with substantively the same misconduct.

It seems that the CFTC has a less than secure grasp of UK corporate law, since over on this side of the pond companies are either "Limited" or "Public Limited" but not both. A quick search of Companies House reveals that the former applies in this case, and that Nav Sarao Futures Limited is in fact registered as limited company number 05497320. The CFTC announcement goes on to say that:

According to the Complaint, for over five years and continuing as recently as at least April 6, 2015, Defendants have engaged in a massive effort to manipulate the price of the E-mini S&P by utilizing a variety of exceptionally large, aggressive, and persistent spoofing tactics. In particular, according to the Complaint, in or about June 2009, Defendants modified a commonly used off-the-shelf trading platform to automatically simultaneously “layer” four to six exceptionally large sell orders into the visible E-mini S&P central limit order book (the Layering Algorithm), with each sell order one price level from the other. As the E-mini S&P futures price moved, the Layering Algorithm allegedly modified the price of the sell orders to ensure that they remained at least three or four price levels from the best asking price; thus, remaining visible to other traders, but staying safely away from the best asking price. Eventually, the vast majority of the Layering Algorithm orders were canceled without resulting in any transactions. According to the Complaint, between April 2010 and April 2015, Defendants utilized the Layering Algorithm on over 400 trading days.

The Department of Justice's own press release on the matter says that:

Navinder Singh Sarao, 36, of Hounslow, United Kingdom, was arrested today in the United Kingdom, and the United States is requesting his extradition. Sarao was charged in a federal criminal complaint in the Northern District of Illinois on Feb. 11, 2015, with one count of wire fraud, 10 counts of commodities fraud, 10 counts of commodities manipulation, and one count of “spoofing,” a practice of bidding or offering with the intent to cancel the bid or offer before execution.

According to allegations in the complaint, which was unsealed today, Sarao allegedly used an automated trading program to manipulate the market for E-Mini S&P 500 futures contracts (E-Minis) on the Chicago Mercantile Exchange (CME). E-Minis are stock market index futures contracts based on the Standard & Poor’s 500 Index. Sarao’s alleged manipulation earned him significant profits and contributed to a major drop in the U.S. stock market on May 6, 2010, that came to be known as the “Flash Crash.” On that date, the Dow Jones Industrial Average fell by approximately 600 points in a five-minute span, following a drop in the price of E-Minis.

According to the complaint, Sarao allegedly employed a “dynamic layering” scheme to affect the price of E-Minis. By allegedly placing multiple, simultaneous, large-volume sell orders at different price points—a technique known as “layering”—Sarao created the appearance of substantial supply in the market. As part of the scheme, Sarao allegedly modified these orders frequently so that they remained close to the market price, and typically canceled the orders without executing them. When prices fell as a result of this activity, Sarao allegedly sold futures contracts only to buy them back at a lower price. Conversely, when the market moved back upward as the market activity ceased, Sarao allegedly bought contracts only to sell them at a higher price.

The charges contained in the complaint are merely accusations, and the defendant is presumed innocent unless and until proven guilty.

The story has generated a number of reports in the Great British Press (GBP for short), some of which are more sensationalist than others. The Daily Telegraph coverage is comparatively sober, and under the headline "Flash crash trader Navinder Singh Sarao 'sat on £27m fortune while his mother worked two jobs'" they report today that :

Mr Sarao denies any wrongdoing and his family believe he has been “set up”.

On Wednesday he appeared before Westminster Magistrates Court in London for a preliminary extradition hearing, and was granted bail conditional on him providing £5 million as a surety.

His full extradition hearing is expected to take place in August.

The Daily Mail's current conclusion (see the "sensationalist" link above) is that:

Modern financial markets, where the speed of software, computers and communications really matter, have opened a new front for the hucksters to dupe a financial system that is vulnerable to manipulation.

It is comforting to know that even if British investigators remain complacent, the Americans are showing a grim determination to clean up the system and make the crucial business of capitalism safer.

However it seems that The Mail has a less than secure grasp of ancient futures markets like the CME and "the crucial business of capitalism", since they also point out that:

Sarao allegedly used an automated computer program to trick the markets into generating orders to sell large numbers of shares – it is claimed more than £100 million worth. (Though it's unlikely he actually owned those shares, it's possible for traders to 'borrow' shares and bet that the market will fall in the hope of cashing them in at a lower price.)

That is comforting to know.

Filed under Regulation by ![]()

I attended the 2015 FIX Trading Community EMEA Trading Conference yesterday at Old Billingsgate in London yesterday. You'll hear more from me about all that in due course, because I'm under strict instructions to "quote check" with assorted speakers before pressing the "Publish" button! However I am able to reveal that I bumped into Kevin Houstoun, Chairman of Rapid Addition, at the post conference "cocktail party". Kevin pointed me at his work on the UK Government's Foresight Review on the Future of Computer Trading in Financial Markets. Here's an overview of that project:

We have previously mentioned Professor Dave Cliff's work on the Foresight Review here, and amongst other things Kevin wrote Driver Review DR31 on "Standards in Computer Based Trading", which pointed out that:

There is considerable evidence, mostly drawn from the real economy, of the impact of standards on industrial output…. Standardisation has been shown to contribute some £2.5 billion a year to growth in the UK economy.

Here's another video in which Kevin goes into more detail about some of his own work on the Foresight Review:

Note particularly the bit (around 2:40) where he says:

The debate about high frequency trading has been very, very polarised. You seem to have almost two camps. You seem to have one side who say 'HFT – Good', and you have the other side who say 'HFT – Bad', and that's been the depth, quite often, of the argument.

Note too that the slides from Kevin's presentation can be downloaded from the LSE web site. Finally, for the moment at least, here's another video which is from the recent "Perspectives on Systemic Risk" conference at the London School of Economics and Political Science which poses the question "What is Systemic Risk":

If you would like to investigate the answer to that question in more depth then please take a good long look at the LSE's "Systemic Risk Centre".

Filed under Regulation by ![]()

It seems FXCM aren't the only forex broker suffering unfortunate side effects following the Swiss National Bank's unexpected announcement yesterday. I have a number of accounts with Alpari UK, fortunately in all the circumstances for test purposes only. Whilst I have yet to receive an email from them on this topic, they have posted the following notice on their web site this morning:

Important announcement

Submitted on Fri, 16/01/2015 – 12:00;

The recent move on the Swiss franc caused by the Swiss National Bank’s unexpected policy reversal of capping the Swiss franc against the euro has resulted in exceptional volatility and extreme lack of liquidity. This has resulted in the majority of clients sustaining losses which has exceeded their account equity. Where a client cannot cover this loss, it is passed on to us. This has forced Alpari (UK) Limited to confirm today, 16/01/15, that it has entered into insolvency. Retail client funds continue to be segregated in accordance with FCA rules.

I suppose I should feel comforted by that final sentence? Or maybe not, if the WorldSpreads saga is anything to go by! I wonder how easy it will be for me to withdraw my funds in this case? If I click the "MyAlpari Login" button on the Alpari UK home page all I see is the announcement shown above.

Filed under Brokers by ![]()

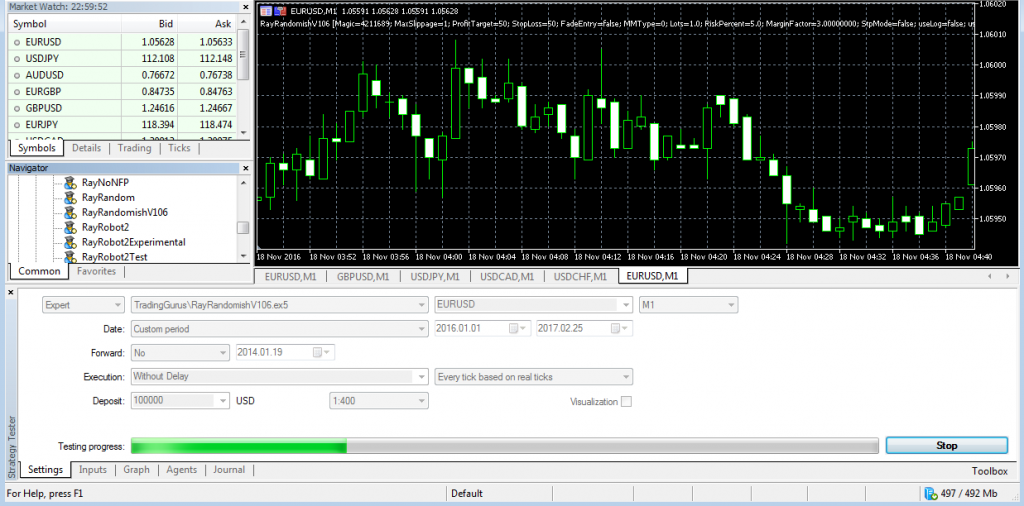

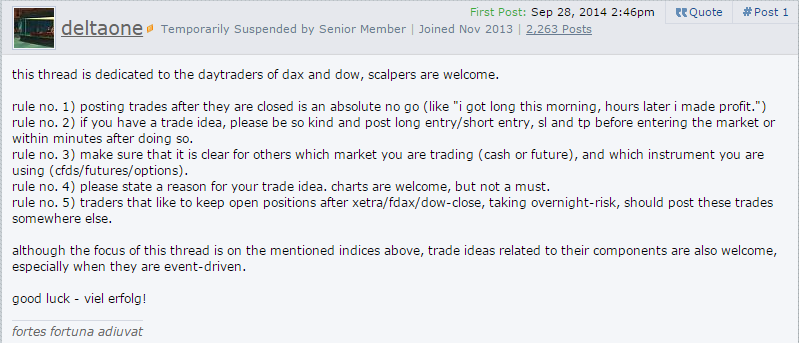

It's a long time since I've visited the forum at Forex Factory. However recently I performed a Google search to discover if anybody else out there trades the DAX in the same way as Ray Robot II, i.e. using breakouts from the previous day's range. That led me to a surprisingly interesting thread on the FF forum. It even possessed a Latin title! Carpe Diem, or "Sieze the day" in English.

I popped in there again this morning only to discover that the thread starter, who uses the nom de guerre "DeltaOne", was strangely silent. It seems that he or she had been "Temporarily Suspended by [a] Senior Member":

Further investigation revealed that this appeared to be the result of a comparatively minor (IMHO of course, and by the current standards of such "frank discussion" on the internet!) difference of opinion about the difference between "talking the talk" and "walking the walk" when it comes to day trading the DAX. I was informed by a regular on the thread that:

Deltaone was "most probably" suspended because of his verbal discussions with GlobalMacro.. after a time period they will unblock him again I guess.. Or he can try to explain what happened and ask for cancellation of suspension to the admins by email. Then it depends how they rate his explanations.

To the best of my knowledge "Twee" is the head honcho over at Forex Factory, and a quick look at his profile revealed the following "shouts" aimed in his direction earlier this month:

It looks as though DeltaOne isn't the only one to have reason to feel aggrieved about heavy handed "censorship" on the FF forum recently? Currently it's 17:00 GMT on December 18th 2014, and DeltaOne is still suspended, which is something of a shame since "Carpe Diem" seems to me to be one of the more interesting (not to mention civilised!) threads on the Forex Factory forum.

More news on "walking" and "talking" if and when we have it.

Filed under Trading Education by ![]()

![The senior members [of FF] who have gone berserk!? The senior members [of FF] who have gone berserk!?](https://trading-gurus.com/wp-content/uploads/2014/12/18/have-some-senior-members-of-forex-factory-gone-berserk/2014-12-18_1428_Twee.png)