Ray Robot Makes More Money Spread Betting with GKFX than with Alpari

Ray Robot II™ has now been running his live spread betting test comparing Alpari UK with GKFX for over a month. We're rather obsessive here at the Trading Gurus, and we've noticed a variety of interesting differences between Ray's four experimental accounts during that time. Some observers have however suggested to us that all that matters in a trading account is "the bottom line". Whilst we humbly disagree with that assertion, Ray is nonetheless now proud to announce that there is at last a difference between the bottom line of his Alpari accounts (currently standing at £255.00) and his GKFX accounts (currently standing at £261.00). There are any number of other (less significant?) differences also.

Let's first of all compare equity curves for Ray's live accounts. Here's how his Alpari UK spread betting account looks this morning:

According to myfxbook the bottom line of £255 can be characterised by a "Profit Factor" of 1.25 following a "Drawdown" of 3.85%. Now here's Ray's GKFX equity curve:

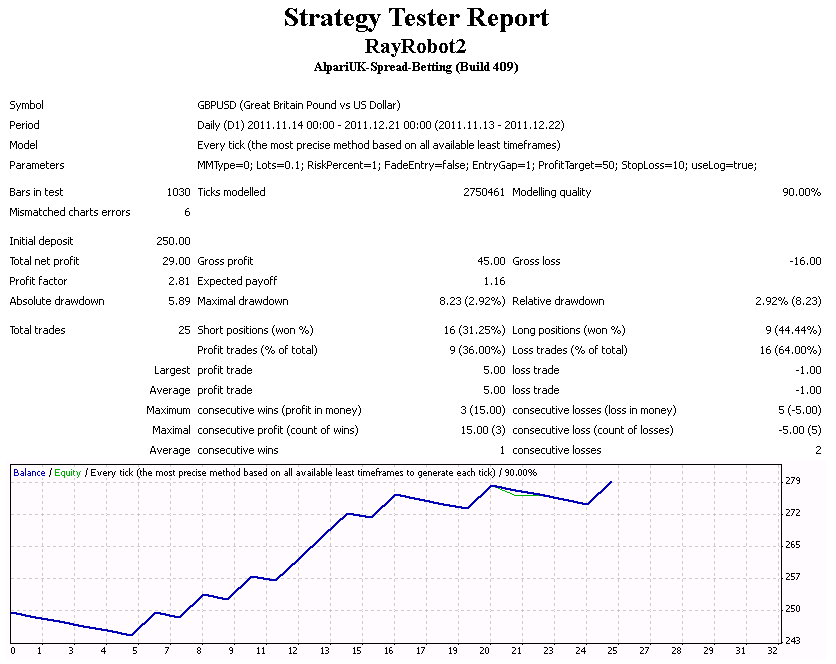

According to myfxbook once more this time around Ray's profit factor is 1.58 after a drawdown of 3.46%. Here's a funny thing though. If you look at Ray's trading accounts at Forex Factory instead of at myfxbook the drawdown numbers are slightly different. Here's another funny thing too. This morning I ran some backtests on the same two accounts, on the same VPS, over the same period of time. Here's what the MetaTrader 4 strategy tester showed me, first for Alpari:

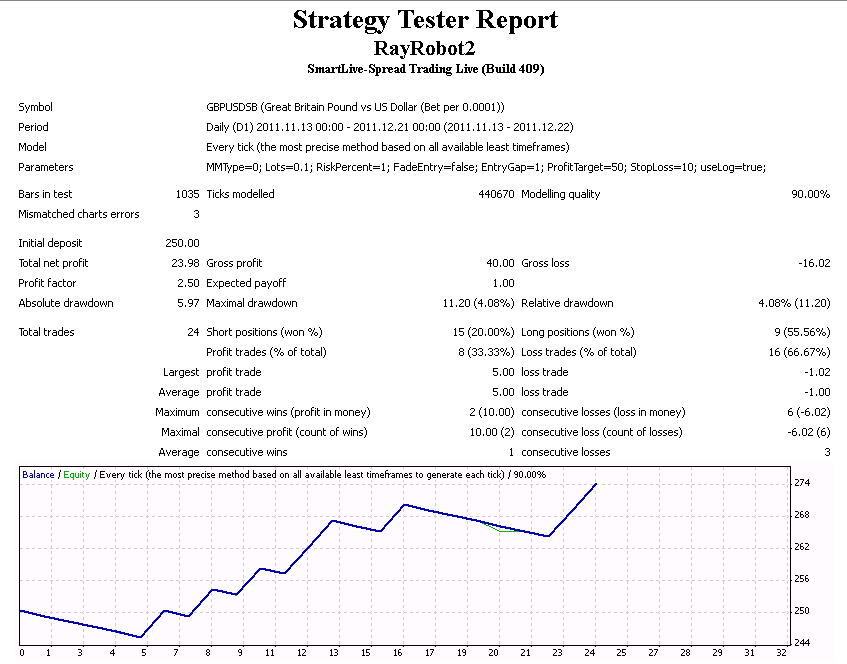

As you can see, in backtests Alpari's version of MetaTrader reports a profit factor of 2.81 following a drawdown of 2.92%. Taking a look at GKFX instead:

As you can see, we have yet another different equity curve, and another set of numbers. This time we're told the profit factor is 2.50 and the drawdown is 4.08%.

Here's an entertaining game for any interested readers to play over the Christmas holiday season. Which of all those different sets of results do you think best represents Ray's future performance trading cable in the New Year? Finally, if you should happen to have some spare cash left over after doing all your Xmas shopping, on the evidence Ray has accumulated so far in his testing would you prefer to open a spread betting account with Alpari UK or GKFX?

Filed under Brokers by ![]()

Leave a Comment