It didn't take long for the next forex lawsuit to arrive, and from the same source too! Following on from their action against FXCM, the Business Trial Group of Morgan & Morgan, P.A. has announced another class action lawsuit, this time against FXDirectDealer, LLC (more commonly known simply as FXDD). According to the announcement the plaintiff this time around is Hugo Cruz, and once more the suit accuses:

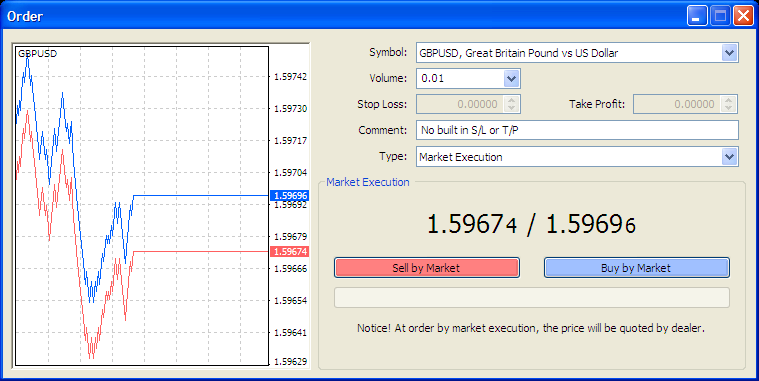

FXDD of fraud by misrepresenting its trading platform as one that is free from dealer intervention or manipulation. Instead, Cruz alleges, FXDD uses a number of devices and tricks, including software applications, designed specifically to manipulate and interfere with customers’ trades.

Like the FXCM case, the suit alleges that FXDD uses specially designed software to manipulate trading and “loot” its customer accounts, and also that FXDD lures its customers by promoting a “demo account,” which was touted as providing customers with a true market trading experience. Instead, the suit alleges, the demo account does not reflect what FXDD does when the customer begins “live” trading.

I can't help but wonder if these forex class action suits are like London buses? You wait ages for one, then three come along in quick succession.

Filed under Brokers by ![]()

In a press release issued earlier today The Business Trial Group of Morgan & Morgan, P.A. announced that it had filed a class action lawsuit today against Forex Capital Markets, LLC (FXCM) alleging fraud and racketeering. My thanks to Michael Greenberg over at ForexMagnates for bringing this interesting piece of news to my attention.

Morgan and Morgan say that FXCM are "the nation's largest Forex dealer", but they don't say how they came to that conclusion. There are lots of ways of doing that calculation, but personally I'd prefer to settle for "one of the largest US retail forex dealers" instead. Be that as it may, Morgan and Morgan are acting on behalf of:

William H. Sanders, of Muscogee, Oklahoma, and all other similarly situated FXCM customers

and are:

Accusing FXCM of fraud by misrepresenting itself as a trading platform that is free from dealer intervention or manipulation. Instead, Sanders alleges, FXCM uses a number of devices and tricks, including software applications, designed specifically to interfere with customers' trades.

Recently the NFA fined GAIN Capital and Ikon for their use (and alleged abuse) of the infamous MetaTrader 4 Virtual Dealer plugin, so quite possibly Morgan and Morgan are going to pursue a similar angle in this case? The press release certainly alleges :

That FXCM engaged in a pattern of racketeering activity by collaborating with its software developers and programmers to develop a "diabolical" software application that provides FXCM with a myriad of tools and system commands with which to interfere with customers' trades, including routing trades to "slow" servers and sending false "error" messages when customers attempt to close out profitable trades.

What with one thing and another I can't help thinking that this won't be the last lawsuit directed at US forex brokers both large and small during 2011.

Filed under Brokers by ![]()

Following their recent IPOs US brokers GAIN Capital and FXCM now seem to be engaged in a battle for the hearts and minds of retail forex traders instead of investors in their respective businesses. In a press release today FXCM announced a new section on their website which they call the FXCM Forex Execution Center. I can't help but wonder if that announcement is in any way related to the new Pricing and Execution section on GAIN's Forex.com website and their Trade Execution Scorecard, which was announced in a press release yesterday.

FXCM's offering explains what they call "The Truth About Forex Trading". This consists of a couple of cartoons explaining the differences between FXCM's "No Dealing Desk" execution model, and "Most of the Other Guys" execution model, which apparently involves a "Dealing Desk". There are also a number of other videos outlining a variety of scenarios in which FXCM's customers might be able to benefit from price improvement on their orders. On the other hand Forex.com are obviously one of the "other guys" FXCM have in mind, since they proudly proclaim:

The benefit of trading with FOREX.com versus a so called ‘no dealing desk’ broker is that we take full responsibility for providing you with consistent liquidity, low spreads, and quality execution on every trade. We don’t outsource that responsibility to third parties, which can result in longer execution times, erratic spreads, and slippage.

whereas FXCM maintain that:

Unlike most other forex brokers, who act as market-makers, FXCM operates on an agency execution model. This is significantly different from brokers who operate a dealing desk execution model, where the revenue per trade is not as transparent. There are common practices, many times unknown to customers, which allow dealing desk firms to make more than just the mark-up attached to the prices streamed from large financial institutions. These practices include, but are not limited to, re-quoting customer trades, taking the opposing side of customers trades, and even preventing customers from trading or managing their positions during news events.

Sounds as though the two companies don't quite see eye to eye on what exactly constitutes "the truth about forex trading", doesn't it?

More on Dealing Desk or No Dealing Desk – Forex.com or FXCM?

Filed under Brokers by ![]()

We've previously pondered how the CFTC might go about enforcing the new forex trading regulations that came into force last October, and now we know one of the tactics they are going to employ. Yesterday the CFTC issued a press release announcing that:

It simultaneously filed 13 enforcement actions in Federal District Courts in Chicago, the District of Columbia, Kansas City and New York, alleging that 14 entities are illegally soliciting members of the public to engage in foreign currency (forex) transactions and that they are operating without being registered with the CFTC.

That list includes 12 RFEDs, the most prominent of which is FXOpen, plus two introducing brokers, all of which the CFTC alleges:

Solicited or accepted orders from US investors to enter into forex transactions in violation of the [Commodity Exchange] Act.

The complaints themselves are all against entities that allow US residents to open accounts, and that also have US offices and/or phone numbers, or US hosted websites and/or trading servers. Apart from requesting that the courts stop the assorted defendants from soliciting US forex traders without being registered, the CFTC also "seeks civil monetary penalties". I'm no lawyer, but it sounds to me as though the CFTC are asking for up to $140,000 per day since last October, plus costs, plus further relief!

It will be very interesting to see how all these cases progress, particularly the ones against entities located outside the US, in jurisdictions such as Canada, the British Virgin Islands, Mauritius and Panama!

Filed under Regulation by ![]()