MetaTrader 4 and fxTrade Cooperate at OANDA

Yesterday we took our first look at the beta version of OANDA MetaTrader 4, and did a little bit of experimental trading. Today we're going to go behind the scenes and take a look at what OANDA's fxTrade platform makes of those same trades, as well as highlighting some important differences between the two platforms.

First of all here's what my OANDA MT4 demo sub-account looks like this morning, viewed from the MetaTrader perspective. Whether you're currrently familiar with either fxTrade or MetaTrader 4 there are some weird things going on in this screenshot:

If you're familiar with fxTrade notice that this is a weekly chart. Notice also that on the left hand side in the MT4 "Navigator" pane you now have a (potentially very long!) list of "Custom Indicators" available to you free of charge. There are also long lists of "Expert Advisors" (often referred to as "robots" in MetaTrader land for some strange reason) and "Scripts", hidden from view in that shot. All these things might possibly help you to partially or totally automate your trading with OANDA. I say possibly, because even though there are vast quantities of all these things downloadable from all over the internet, the majority of them are totally useless when comes to assisting you in becoming a profitable trader, and for a wide variety of reasons too.

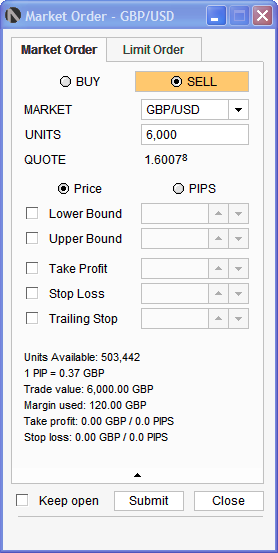

If you are instead familiar with MetaTrader 4, and hence with lots of useless indicators and "robots", notice instead that in the MT4 "Account History" tab at the bottom there are some unfamiliar entries labelled "Balance Update" and "Interest". Lets now take a look at the very same account, but from the fxTrade perspective. Since MetaTrader 4 prevented me from doing a stop and reverse with a single click yesterday, I tried doing the same trick with fxTrade instead. Here's what my order entry ticket looked like:

Before I clicked the "Submit" button I was long 0.03 "Lots" , courtesy of my earlier MT4 trades. After I clicked "Submit" I very soon found myself short 3,000 "Units" instead:

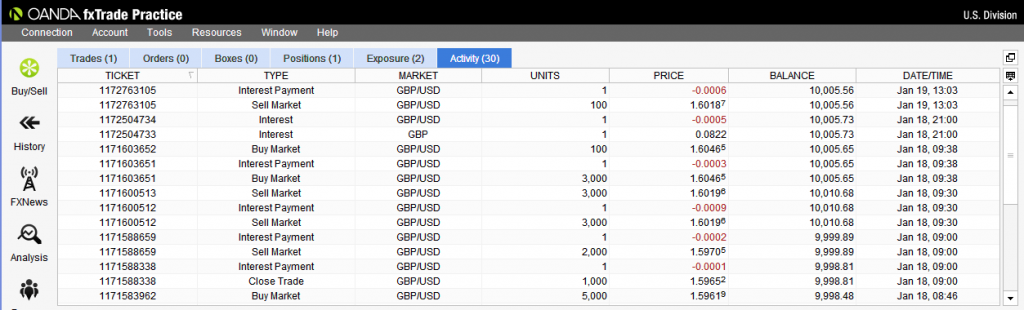

Now let's take a look at how fxTrade accounts for all that frantic trading activity. Here's how my MT4 sub-account looks this morning:

Notice how what MetaTrader brokers call swap is instead referred to by OANDA, as interest, and that it's calculated based on the duration of your trade instead of only once every evening. Note too that OANDA credit your account once a day with interest accrued by your account cash balance. You don't often see that from a MetaTrader broker, but if you look closely you can see it in the first screenshot above too!

Finally note that using OANDA MetaTrader 4 your smallest possible trade size is 1,000 units (a micro-lot). Using fxTrade your smallest possible trade size is 1 single unit! I experimented with what an MT4 broker would refer to as a nano-lot yesterday, by buying 100 units of cable at 9:38 yesterday using fxTrade. I let that trade run overnight, then closed it this morning. The trade never showed up in my MetaTrader client terminal in it's own right, since OANDA MT4 doesn't know how to handle trades that small. Evidence of its existence is there though, courtesy of those otherwise mysterious "Balance Update" entries.

So there you have it. If you open an OANDA MetaTrader capable sub-account as and when live trading becomes available you'll be able to trade tiny lot sizes with "tight spreads", get paid "swap" on your cash, and view weekly or monthly charts with more indicators on than you even knew existed. What do you make of this statement from the recent spreads section of OANDA's web site though?

The spreads offered on OANDA fxTrade vary over time. OANDA is the counter-party to trades executed over fxTrade. Trades are matched, and any net exposure above predefined thresholds is hedged with partner banks at the current market spread. Global market liquidity and volatility can result in large spread increases on the foreign exchange markets following news announcements, during political uncertainty, or at the close of the business day and on weekends when liquidity is lower. At such times OANDA is forced to pass on some of the spread increases to its clients.

Is OANDA fxTrade with added MT4 really the best of both worlds, or even the best of either world come to that?

Tags: Beta, Forex Trading Platform, fxTrade, MetaTrader, Oanda

Filed under Trading Platforms by Jim ![]()

Leave a Comment