OANDA Announce the "Imminent" Arrival of MetaTrader 4

In an announcement on their FXMessage forum forex broker OANDA revealed yesterday that:

You will soon be able to access OANDA’s tight spreads from MT4’s popular graphing, automation, customization, and community-based features.

Here at the Trading Gurus we've been beta testing OANDA's MetaTrader 4 implementation for a while, since amongst other things this announcement opens up the prospect of automated forex trading at OANDA without having to pay their current API fees. Here's our brief overview of what you can look forward to if you're a MetaTrader 4 user wondering if OANDA's "tight spreads" are worth looking at in more detail, or if you're currently an fxTrade user wondering what the recent MetaTrader fuss is all about.

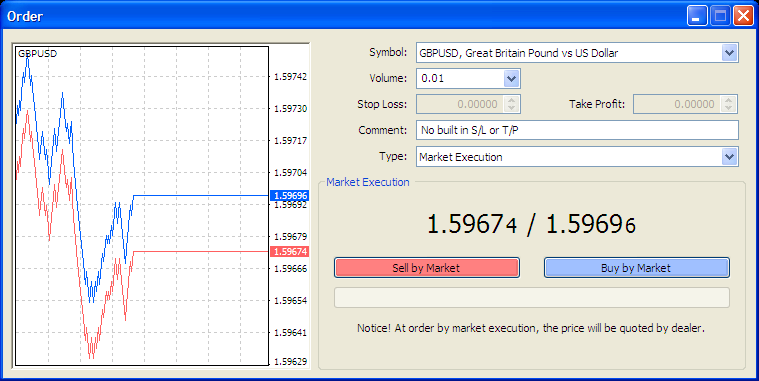

To experience OANDA's demo MetaTrader 4 you'll need to start with an fxTrade practice account, then add an MT4 sub-account. Having done that you can then access that sub-account using both the fxTrade Java platform and the MetaTrader 4 Windows client terminal. We'll start with the MetaTrader 4 view of things. Here's what placing a market order looks like:

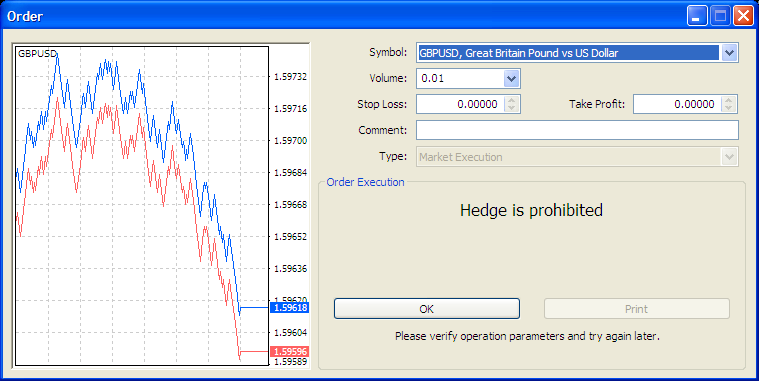

As you can see, OANDA MT4 supports what most MetaTrader brokers refer to as micro-lots. As you can also see, you can't place a market order that includes a built in stop and/or target. Once your order has been filled you can then modify it and tack on your desired stop loss and take profit levels. If you're using one of our example expert advisors on OANDA MT4 that means you need to make sure the StpMode input setting is changed to "True". There are other limitations that might come as a bit of a surprise too, if you're coming to OANDA MT4 from either fxTrade or a European MT4 broker. For example you can't close a position "futures style", by placing an equal and opposite order:

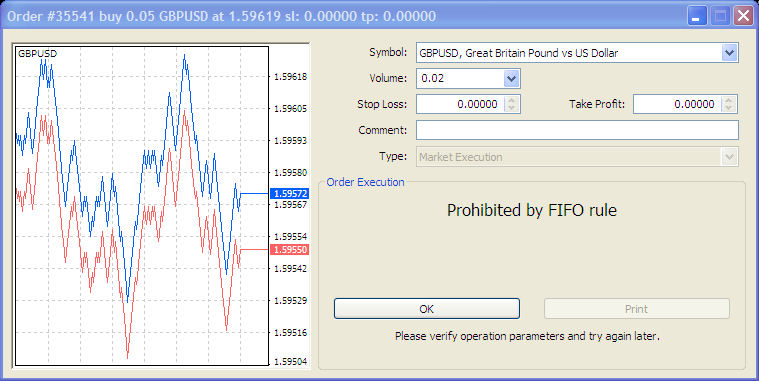

MetaTrader 4 doesn't actually have any concept of "positions", it only knows about "orders". The means you have to be careful to close your "orders" in the correct order. If you've scaled into a "position" you might unexpectedly get to see something like this when you try to scale out:

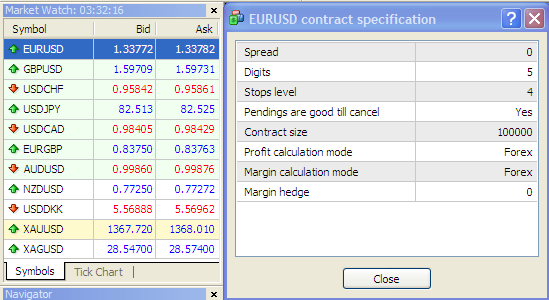

Fortunately you do seem to able to perform partial closes, as long as you do them in the right order! If you're used to all these hassles, because you're a US citizen and you already have an account with a MetaTrader 4 broker, then you won't be surprised to learn that the maximum leverage available is 50:1, and you're probably most interested in those "tight spreads". You can get an idea of that from the tick charts above, but here's what is probably a more interesting picture:

As you can see OANDA's spreads are variable, but shortly after the "London Open" today the spread on EUR/USD was 1.0, USD/JPY was 1.2 and GBP/USD was 2.2. Notice too that when you do get around to adding stops and targets to your OANDA MT4 orders, you can't place them too close to the market price. The stops level is 4 pips on EUR/USD, and 6 on USD/JPY and GBP/USD. In conclusion notice also that OANDA provide quotes for precious metals as well as spot forex, but that other commodities, indices and the like are conspicuous only by their absence.

That's a very brief overview of an OANDA MetaTrader sub-account from the MT4 client angle. Stay tuned for our next blog post, where we'll take a look at the same account from the fxTrade angle instead.

Tags: API, Beta, Forex Trading Platform, fxTrade, Java, MetaTrader, Micro-lots, Oanda

Filed under Trading Platforms by Jim ![]()

Leave a Comment