LMAX have finally overcame some inital teething troubles with their recently revamped historical data feed, and earlier today I was finally able to fire up my copy of LMAX's flavour of the MultiCharts platform. for the very first time. Here's the first thing that met my eyes:

As you can see, for initial testing I'm using my trusty LMAX demo account! After filling in my user credentials, and then a slight bit of tweaking of the screen layout, this was the result:

Please click the image to see an enlarged version. As you will then hopefully be able to see, charts now quite happily display historical data, and manual trading works fine too. On the left hand side full depth of market information is available, and below that buttons that allow you to utilise complex entry order types including OCO "fade" and "breakout" strategies.

The MultiCharts platform is packed full of other features that you won't find in MetaTrader 4, including a wide range of exotic instruments and chart types. Here's what constant range bars of US 30 year T bonds looks like for example:

This very brief overview only hints at the overall power of the MultiCharts platform. We will cover many more of its features over the coming days, including a close look at building automated trading strategies using EasyLanguage instead of MQL4. Note in conclusion that if you're a discretionary trader and you like the look of MultiCharts, a version of MultiCharts without automation capabilities is available for download free of charge from the MultiCharts website.

Filed under Trading Platforms by ![]()

At last we know the answer to the questions posed by FXCM themselves back in August following settlement of charges brought by the NFA, when they revealed that:

FXCM has set aside a $16 million reserve for the…. anticipated CFTC settlement.

Yet again the CFTC have simultaneously:

Issued an order filing and simultaneously settling charges

against FXCM, and they have just issued a press release which states that:

According to the CFTC order, from at least June 18, 2008 until December 17, 2010, FXCM failed to supervise diligently the handling of more than 57,000 customer accounts traded on the FXCM platforms by its officers, employees, and agents with respect to changes in price between order placement and execution on both market orders and margin liquidation orders. The order finds that FXCM’s failure prevented its customers from receiving the benefit of price movements in customers’ favor, but allowed its customers to suffer detrimental price movements. The CFTC order finds that had FXCM diligently supervised its personnel, FXCM would have discovered these problems with its trade integrity and would have had the opportunity to correct them before its customers were deprived of, and FXCM benefitted by, approximately $8,261,937.

Further, the CFTC order finds that FXCM failed to produce certain records promptly in its capacity as a CFTC registrant and thereby required the CFTC to issue a subpoena to attempt to obtain required records from FXCM.

That covers the alleged offences, but what about the headline figure of a fine of over $14.2 million. On that side of the equation the CFTC has this to say:

The CFTC order requires FXCM to pay a $6 million civil monetary penalty and restitution of $8,261,937 to its customers and former customers. In addition, the CFTC order requires FXCM to retain, at its own expense, a monitor to review for three years:

- Its trade execution practices and policies as they relate to the change in price between the time the customer places the order and the time the order is executed by FXCM

- Its compliance with its restitution obligation.

The "monitor at its own expense" clause explains the "more than" in the title, and apart from tying that number down more tightly that is quite possibly the last such news we will hear for a while regarding sanctions against U.S. public FX brokerages. However there is still much more news to come regarding the settlement of CFTC actions brought in the U.S. courts against a long list of overseas brokerages.

Filed under Regulation by ![]()

According to Michael Greenberg over at ForexMagnates his:

Sources reveal that Gain Capital is about to seal the deal with Interbank FX. No information is yet known and neither company confirmed the information – naturally because Gain is a public company. More details are expected soon.

We have speculated here on the likelihood of continuing consolidation in the retail forex "industry", particularly following the IPOs of GAIN and FXCM. No doubt the trend will continue for a while yet in the wake of regulatory changes, not to mention the activities of those regulators' lawyers! In all the circumstances it's an interesting coincidence that we mentioned IBFX in passing only this morning. Assuming that the acquisition goes ahead as Michael suggests, perhaps Forex.com will eventually start marketing EAs that don't work terribly well to their customers too? They do operate a dealing desk after all!

Filed under Brokers by ![]()

Following on from last month's European attack on the City of London a new front has opened up in the war currently being waged to regulate away risk in the world's financial markets. However this time around Britain is fighting back in the courts! Bloomberg reports that:

Britain will sue the European Central Bank over plans to prevent some euro-denominated securities from being cleared outside the 17 countries that share the currency, in the first such move by a government.

In this instance the supposed problem isn't high frequency trading. Rather it's the ECB's desire not to find itself in the position of having to bail out clearing houses for euro denominated derivatives that are not located in the euro zone. According to Bloomberg once more:

Clearing houses such as LCH.Clearnet and Deutsche Boerse AG’s Eurex Clearing operate as central counterparties for every buy and sell order executed by their members, who post collateral, reducing the threat from a trader’s default.

European Union governments have discussed giving clearing houses access to central-bank liquidity as a way to prevent them from collapsing and causing a financial crisis. The European Commission said last year that access to central bank liquidity could be useful in preventing clearing houses becoming a source of risk to the financial system in themselves. It included the idea in proposals it made in September 2010 to push trading of over-the- counter derivatives through central clearing.

The ECB has said clearing activities should take place in the euro region if it is expected to provide such financial support.

The British Government doesn't see it this way however. They maintain that:

The ECB’s policy contravenes European law and fundamental single market principles. The government wants to see this resolved swiftly and without involving the courts but if necessary will not shy away from continuing legal action.

Having said all that, perhaps there is more to this war than merely reducing financial instability?

The development comes as London Stock Exchange Group Plc holds talks with LCH.Clearnet Group Ltd. to buy all or part of the world’s biggest clearing house for swaps, as increased global regulation makes the business more profitable.

Filed under Regulation by ![]()

Fresh from agreeing a settlement with FXCM's UK subsidiary, the CFTC has stepped up its campaign in the courts against "unregistered" RFEDs by announcing that it is bringing civil actions against another 11 foreign currency firms. As in their first such sweep a number of those firms are based in far away places such as Belize, the British Virgin Islands and Cyprus. However two names stand out in the CFTC's blacklist of miscreants as being more "onshore" than the others, namely:

City Credit Capital, (UK) Ltd., a United Kingdom company;

and:

Enfinium Pty Ltd., an Australian company;

Both actions have been filed in "the United States District Court for the northern district of Illinois eastern division" rather than in the UK or Australian courts. Enfinium acquired Australian broker Vantage FX last year, and it is the Vantage name that the CFTC cite in their complaint. More recently a significant stake in Enfinium was acquired by China Private Equity Investments Holdings Limited who are listed on the London Stock Exchange's AIM market, and were thus happy to announce recently on the LSE's Regulatory News Service that:

The Board of CPE is delighted to announce that the title "Best Forex Broker in South East Asia" has been awarded to the forex broking arm of Enfinium International Holdings Limited ("Enfinium"), in which CPE recently acquired a 30% stake.

The prestigious accolade, won in competition against nearly 140 other international brokers participating in the 2011 IBTimes Trading Awards in New York City, went to Vantage FX, a Corporate Authorised Representative of Enfinium. VantageFX also collected a "Forex Broker Australia – Excellence Award".

The IBTimes Trading Awards claims to be the most comprehensive annual award series within the fast-growing retail forex market.

In both cases the CFTC alleges that:

Beginning on October 18, 2010 and continuing to the present (the “relevant period”), [the firm] solicits or accepts orders from non-ECPs located in the United States in connection with retail forex transactions and is, or offers to be, the counterparty to these retail forex transactions without being registered as an RFED with the CFTC, in violation of Section 2(c)(2)(C)(iii)(I)(aa) of the Act, as amended, to be codified at 7 U.S.C. § 2(c)(2)(C)(iii)(I)(aa) and Regulation 5.3(a)(6)(i), 17 C.F.R. § 5.3(a)(6)(i).

and that:

Venue properly lies with the Court pursuant to Section 6c(e) of the Act, as amended, to be codified at 7 U.S.C. § 13a-1(e), because [the firm] transacts business in this District and certain transactions, acts, practices, and courses of business alleged in this Complaint occurred, are occurring, and/or are about to occur within this District.

Whilst Vantage FX may not be registered in the U.S. as an RFED, they are registered with the Australian Securities and Investments Commission. The Vantage FX name is even registered here in the UK as well, although this is just a licence to use the brand and the two companies have no other legal connection. Whatever else they may be, CPE/Enfinium/Vantage are certainly not a run of the mill offshore bucket shop. Neither are City Credit Capital (UK) Ltd for that matter. They too are currently registered in the UK with the Financial Services Authority, and on their website they proclaim that:

The senior management team at City Credit have worked across the globe and have been drawn together from some of the world's premier financial institutions including HSBC, Citigroup and Société Générale.

It looks as though neither Enfinium or City Credit are rushing to follow in FXCM's footsteps and cough up a few hundred grand to settle matters with the CFTC. Meanwhile here at the Trading Gurus we're eagerly waiting to discover how these actions taken by the CFTC in the US courts might result in sanctions against offshore FX brokers that are properly registered within their own jurisdictions and who aren't so eager to reach a quick settlement. In their latest press release the CFTC has this to say about their first batch of court actions:

With respect to the similar actions filed in January 2011, 11 of the 14 defendants have either settled the charges or defaulted, and the charges against the remaining three are pending.

The CFTC strongly urges the public to check whether a company is registered before investing funds. If a company is not registered, an investor should be wary of providing funds to that company.

Filed under Regulation by ![]()

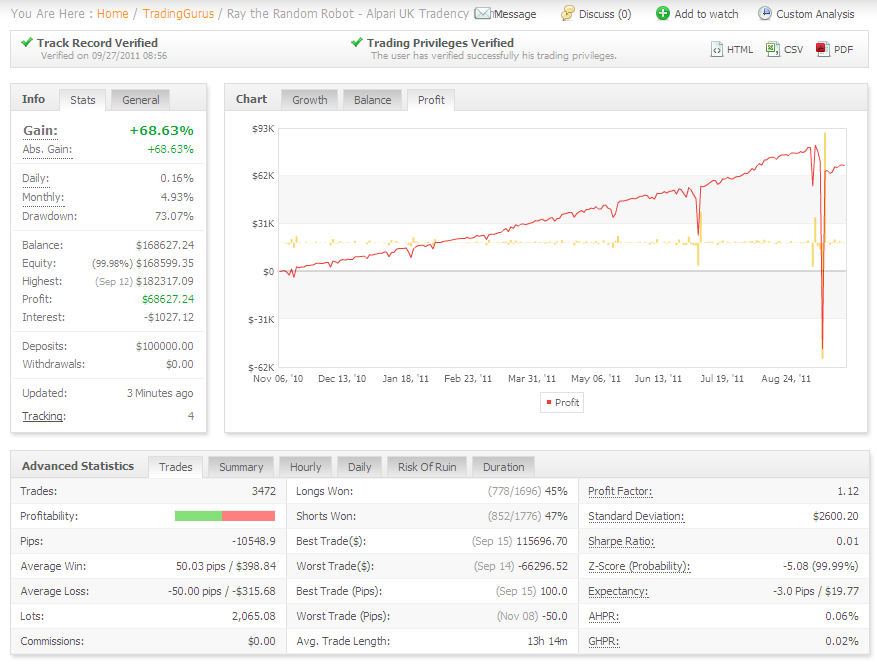

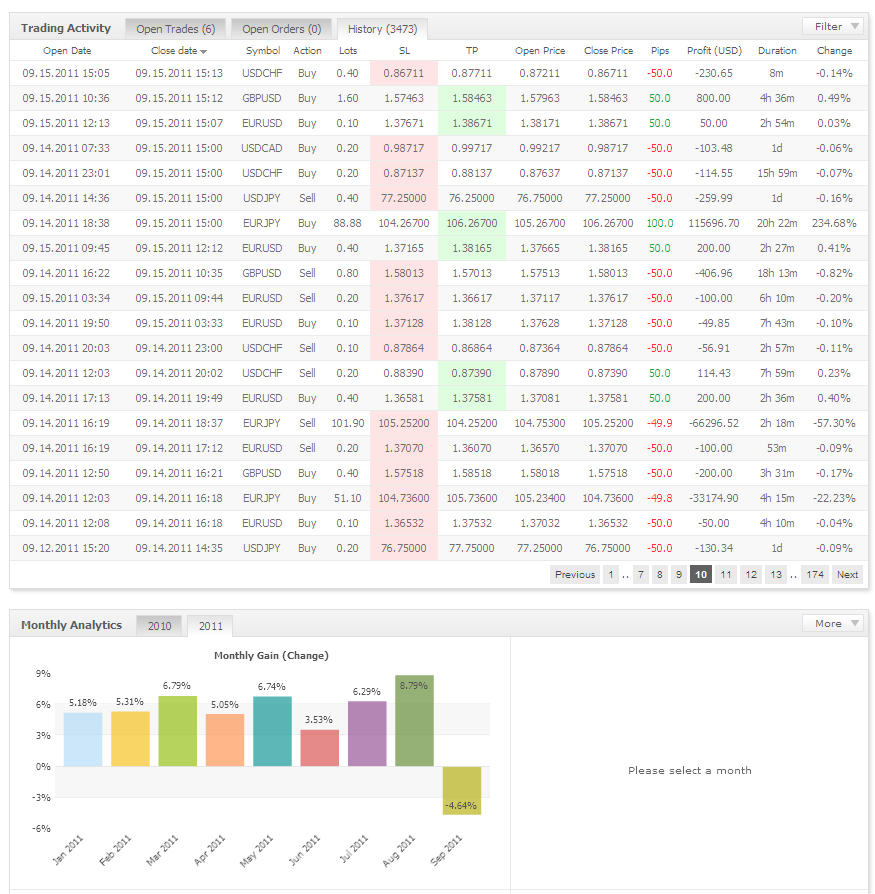

At the request of one of our loyal readers we've just opened up a new section on the Trading Gurus community forum devoted to Artificially Intelligent Trading. As other loyal readers will know, here at the Trading Gurus we love Ray the Random Robot and his particular brand of Artificially Stupid Trading. However we're also very open minded, not to mention modest! Apart from anything else we're keen to discover how other sorts of "robots" go about earning their keep. Some interesting debates have already started on the forum, where Pippa has recently revealed some very interesting news.

Starting on October 10th 2011 the Stanford University School of Engineering is running:

A bold experiment in distributed education, "Machine Learning" [and "Introduction to Artificial Intelligence"] will be offered free and online to students worldwide during the fall of 2011. Students will have access to lecture videos, lecture notes, receive regular feedback on progress, and receive answers to questions. When you successfully complete the class, you will also receive a statement of accomplishment.

Ray is certainly very interested in learning some new trading tricks, and he wondered if you might be as well. Here's a video to give you some idea about what's on the curriculum:

Filed under Course by ![]()

My attention has recently been drawn to an academic research paper entitled High Frequency Trading and The New-Market Makers. The author, who is from the VU University in Amsterdam, investigates the connection between high frequency trading and the emergence of new exchanges here in Europe:

It shows how the success of a new market, Chi-X, critically depended on the participation of a large HFT who acts as a modern market-maker. The HFT, in turn, benefits from low fees in the entrant market, but also uses the incumbent market Euronext to offload nonzero positions.

To summarise the findings:

One particular set of broker IDs matched across markets shows the characteristics of an HFT that acts as a market maker in both the entrant market (Chi-X) and the incumbent market (Euronext). In each market, four out of five of its trades are passive, i.e., the HFT was the (liquidity-supplying) limit order in the book that got executed. It makes money on the spread but loses money on its positions. If this positioning loss is decomposed according to duration, one finds that positions that last less than five seconds generate a profit whereas the ones that last longer generally lose money. The HFT is equally active in both markets as roughly half of its trades are on Chi-X and the other half are on Euronext.

and:

The paper shows how fees are a substantial part of a high-frequency trader’s profit and loss account. It is therefore not surprising that new, low-fee venues have entered the exchange market as they are attractive to these ‘modern’ market makers. It is shown that such lower fees are, at least partially, passed on to endusers through lower bid-ask spreads. This evidence adds to the regulatory debate on high-frequency traders and highlights that a subset is closely linked to the rapidly evolving market structure that is characterized by the entry of many new and successful trading venues.

This research seems to suggest that high frequency trading is actually a good thing, both for the "New-Market makers" themselves and the beneficiaries of the resulting lower bid-ask spreads on new exchanges such as Chi-X.

However this view doesn't seem to be held by regulators on both sides of the Atlantic, since as we discussed back in 2009, both SEC chairman Mary Schapiro and the then UK "City minister" Lord Myners held the view that:

We need a deeper understanding of the strategies and activities of high frequency traders and the potential impact on our markets and investors of so many transactions occurring so quickly. And we need to consider whether there are additional legislative authorities needed to address new types of market professionals whose activities may not be sufficiently regulated.

It seems as though the US legislative authorities have been as good as their word, since one of the references at the back of HFT & The New-Market Makers is another academic paper. This one is entitled "The Flash Crash: The Impact of High Frequency Trading on an Electronic Market", and the authors hail from another US regulator. In this case it's the CFTC. They conclude:

Based on our analysis, we believe that High Frequency Traders exhibit trading patterns inconsistent with the traditional definition of market making. Specifically, High Frequency Traders aggressively trade in the direction of price changes. This activity comprises a large percentage of total trading volume, but does not result in a significant accumulation of inventory. As a result, whether under normal market conditions or during periods of high volatility, High Frequency Traders are not willing to accumulate large positions or absorb large losses. Moreover, their contribution to higher trading volumes may be mistaken for liquidity by Fundamental Traders.

We conclude that HFTs did not trigger the Flash Crash, but their responses to the unusually large selling pressure on that day exacerbated market volatility.

Not exactly the same conclusion as the Dutch paper then, and not exactly a clean bill of health either. However exacerbating market volatility isn't quite the same thing as destroying Western capitalism as we know it.

Not content with leaving these matters to the Anglo Saxons, it seems Angela Merkel and Nicolas Sarkozy have been discussing similar issues recently. According to the Daily Telegraph Mr Sarkozy said:

The French and German ministers will table a joint proposal at EU level next September for a tax on financial transactions. This is a priority for us.

This so called "Tobin Tax" has been previously mooted as one way of making high-frequency trading unprofitable, and thereby ridding the world of its menace once and for all. According to the Telegraph once more:

The plans by Germany and France to introduce a financial transaction tax (FTT) could raise a total €80.9bn (£70.7bn) – of which €58.3bn would come from UK-based businesses.

As you may be able to imagine, this Continental concept hasn't gone down too well with some of the aforementioned UK-based businesses. In particular Michael Spencer, founder and CEO of ICAP and last year's Ernst & Young World Entrepreneur Of The Year, seems to have taken a very dim view of it. According to Mr. Spencer:

This tax would destroy the City and cost the Exchequer billions, but it would benefit Brussels. Companies like ICAP will simply move elsewhere outside the EU if Nicolas Sarkozy and Angela Merkel push ahead with this silly tax.

Unlike their Labour predecessors, it seems as though the current Tory government isn't wild about the plan either:

Last week, Treasury sources signalled that Britain would be prepared to veto such a tax if Paris and Berlin succeed in bringing the plan to a vote among 27 EU members.

I'm sure that Mr. Spencer's donations to the Tory party have no bearing on any of that, but all these conflicting signals are nonetheless terribly confusing. If you're currently an Anglo Saxon high frequency trader now would seem like a prudent time to consider plan B, if you haven't done so already.

Filed under Regulation by ![]()

Yesterday evening customers of UK spreadbet and forex/CFD broker Smart Live Markets received an email announcing that:

Smart Live Financial Services Ltd will be changing its name in the coming weeks to GKFX Financial Services Ltd.

According to the email:

The reason for this change is cosmetic. As we have grown globally as a company it has been apparent that some people have been confused by our name, so we have chosen a more generic name which as a brand going forward will be far more easily recognised throughout the world.

When I enquired about why such a "cosmetic" change was necessary I was told that the Smart Live brand is associated in many people's mind with the gaming industry, and that such an association is likely to be a hindrance to the expansion of Smart Live/GKFX in the Middle East. It seems that while spread betting is classified as gambling in the UK, trading forex and CFDs is not in the rest of the world (or in the UK for that matter!).

When I further enquired about the significance of the GKFX name I was told it was a four letter domain name ending in FX that happened to be available. According to Smart Live's entry in the FSA register it stands for Global Kapital FX, but apparently for some reason no marketing will be done using that version of the new name!

Filed under Brokers by ![]()