Buru Trader Blows Up

If you're from the United States you may well never have heard of Buru Trader. However if you're a customer of Interbank FX Australia like me, you probably will have done. It's a bundle of two MetaTrader 4 expert advisors called "buru New York" and "buru Tokyo", which IBFX Australia have been promoting over the last few months. On March 15th IBFX were inviting their customers to find out about:

An exclusive MT4 Expert Advisor Buru, powered by our revolutionary technology

and suggesting that you might like to:

Revolutionise your trading. IBFX Australia is the exclusive execution platform for Buru, the MT4 EA that has consistently earned impressive gains since June 6, 2010:

* Average Weekly Return: +2.5%*

* Average Monthly Return: +10.7%*

* Full History of 267 days: +151.06%*

Buru is an EA that requires the cutting-edge proprietary technology found with IBFX Australia.

* Past performance is not necessarily indicative of future results. Individual results may vary.

That last point certainly seems to have been rather prescient, since whatever the merits of Interbank FX's cutting-edge technology Buru itself has turned out to be anything but revolutionary. According to an email I received from IBFX Australia on March 14th:

Prior to partnering with IBFX Australia, Buru's system was tested with multiple MT4 brokers. The results were far from satisfactory until IBFX Australia surpassed expectations with their live account performance, superior execution and liquidity management.

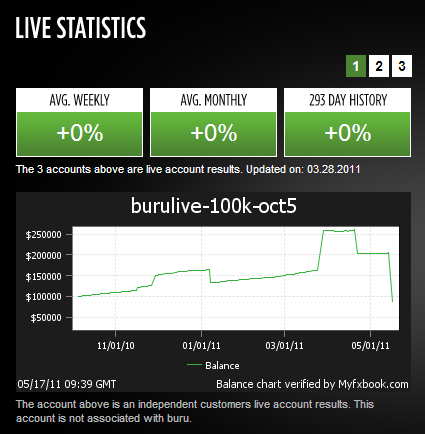

Even in partnership with IBFX Australia, the results of Buru's system(s) have now proved to be far from satisfactory once again. Initially Buru Partners were keen that prospective purchasers of their EAs should view some "Customer Live Account Statistics". As you can see, that page currently doesn't seem to be working properly. However there are still some "live" statistics visible on the Buru home page, which look like this at the moment:

Click the image to see more detailed statistics about "an independent customers live account" courtesy of myfxbook. According to myfxbook the loss on this account currently stands at $151,712.99. It looks as though you need some very deep pockets indeed to be able to let Buru Trader loose on your account without the "robot" wiping it out for you! For another perspective on what seems like a big problem with Buru we did some backtesting here at Guru Towers, using version 1.2 of the Buru New York EA on the EUR/USD pair with the default "Risk Factor" of 0.5 and starting on June 6th 2010. This is what we discovered:

The first thing to note is that a taste of things to come had already occurred on December 17th 2010, when the largest trade size rose to 3.25 and the backtest balance briefly plummeted. The second thing to note is that the backtest finished prematurely at 3:56 on May 2nd 2011, by which time the maximum open trade size had risen to 5.84. That trade was "closed at stop" along with the other 22 that were open at the time.

Next we took a look at Buru Tokyo, again using the default settings over the same period of time and on the EUR/USD pair. This is what the MT4 strategy tester revealed:

This time around it looks like Buru Tokyo decided to short the euro early on the morning of April 19th. Inconveniently for Buru users the euro then decided to rally. As it did so Buru Tokyo kept on selling in ever greater size, all the way up until at 8:48 the following day it finally decided to cut its losses and closed all 13 shorts for a loss of around half the account.

What is the moral of this cautionary tale? Take a look at Ray the Random Robot's equity curve, which you can find handily located just to the top left of this post. Click on it if you'd like to check out some more detailed statistics courtesy of myfxbook. Amongst other things Ray demonstrates how easy it is for even the dumbest of "robots" to produce an impressive looking equity curve that keeps on looking impressive for far longer than the 30 day money back guarantee period offered by Buru Trader, or even the 60 days that comes with some other expert advisors. Ray's "secret" is the same as Buru's. They both increase their trade size after taking a loss. Ray uses a fixed stop loss and martingale money management, whereas Buru uses a grid system with no traditional stop losses, but the end result is the same. The problem is that when you eventually suffer an extended sequence of losses with such robots you'll find you need to hurriedly fund your trading account with large quantities of cash to avoid disaster. If you're unable to do that you'll just have to look on helplessly as your account rapidly disappears before your very eyes, assuming you're awake at the time that is.

Tags: Backtesting, Buru Trader, IBFX, MetaTrader, MMM, Money Management, myfxbook, Robots, RRR™

Filed under Trading Systems by Jim ![]()

Leave a Comment