It's all go on the mergers, acquisitions and transfers front this week! Swissquote Bank announced in a press release earlier today that:

Swissquote Bank is acquiring a 100 percent holding in MIG Bank effective 25 September 2013. The acquisition of this major forex broker secures Swissquote Bank a place among the world’s largest forex service providers. The goal is to merge MIG Bank with Swissquote Bank.

Founded in 2003 as MIG Investments, MIG Bank employs an overall workforce of 120 at its headquarters in Lausanne and offices in Zurich, London and Hong Kong. In 2009, MIG Bank became the first forex broker to obtain a Swiss banking license. MIG Bank has specialized in online forex trading since its foundation, establishing itself as one of the leading forex and CFD brokers for clients in over 120 countries. It is one of the top providers worldwide in this sector.

The purchase of MIG Bank will enable Swissquote to greatly expand its forex operations, which at a volume of CHF 158 billion accounted for 26.2 percent of total net revenues in the first half of 2013. In the same period, Swissquote and MIG Bank would have achieved a cumulative volume of CHF 483 billion. Going forward, net forex income is likely to represent about half of the total net revenues of the group.

Thanks to the acquisition, Swissquote will also enjoy a broader international presence in future, with locations in Switzerland (Gland, Zurich and Bern), Dubai, Malta, London and Hong Kong. The relevant authorities in Switzerland, the UK and Hong Kong have approved the transaction.

The purchase of MIG Bank was financed entirely with equity capital. The parties have agreed not to disclose the purchase price. Following the acquisition, Swissquote Bank will continue to have one of the highest core capital ratios among Swiss banks.

After Alpari transferred their US retail business to FXCM last week and OANDA acquired Currensee earlier this week, I can't help but wonder when the next global forex mega-merger will be announced.

Filed under Brokers by ![]()

In a press release this morning the US Commodity Futures Trading Commission announced that it has:

Today issued an Order against ICAP Europe Limited (ICAP), an interdealer broker, bringing and settling charges of manipulation, attempted manipulation, false reporting, and aiding and abetting derivatives traders’ manipulation and attempted manipulation, relating to the London Interbank Offered Rate (LIBOR) for Yen. LIBOR is a critical benchmark interest rate used throughout the world as the basis for trillions of dollars of transactions. ICAP is a subsidiary of U.K.-based ICAP plc.

The CFTC’s Order finds that for more than four years, from at least October 2006 through at least January 2011, ICAP brokers on its Yen derivatives and cash desks knowingly disseminated false and misleading information concerning Yen borrowing rates to market participants in attempts to manipulate, at times successfully, the official fixing of the daily Yen LIBOR.

The Order requires ICAP, among other things, to pay a $65 million civil monetary penalty, and cease and desist from further violations as charged. Pursuant to the Order, ICAP and ICAP plc also agree to take specified steps to ensure the integrity and reliability of benchmark interest rate-related market information disseminated by ICAP and certain other ICAP plc companies.

In a separate statement about the settlement order, CFTC Chairman Gary Gensler said that:

Today’s Order against ICAP once again shows how LIBOR, a critical benchmark interest rate not anchored in sufficient transactions, has been readily rigged. Unfortunately, this is yet another reminder of why we have to coordinate internationally to transition to an alternative to LIBOR to best restore the integrity to markets.

Today’s Order also highlights the importance of Congress’ reforms through the Dodd-Frank Act to bring oversight to swaps trading platforms. Required registration of swap execution facilities becomes a reality next week, finally closing exemptions that had allowed for unregistered, multilateral swaps trading platforms.

The CFTC press release also points out that:

In a related action, the United Kingdom Financial Conduct Authority (FCA) issued a Final Notice regarding its enforcement action against ICAP Europe Limited and imposed a penalty of £14 million, the equivalent of approximately $22.4 million.

Filed under Regulation by ![]()

In a press release today Argon Design from Cambridge in the UK have announced what they describe as:

A high performance trading system using a heterogeneous mix of technologies to minimize trading latency.

The mix of technologies is provided by their use of the Arista Networks 7124FX application switch which:

Includes an Altera FPGA with hardware-level access to 8 of its 24 10Gb Ethernet ports and an x86 domain based on Intel’s Xeon processors.

According to project's "case study" on the Argon web site, they have:

Developed a prototype system where market data feed analysis and fast-path trade execution is performed directly on the switch under rules determined in parallel on “traditional” processors.

Direct FPGA access allows data feeds to be parsed and analysed as close as possible to the feed handlers. Similarly the heterogeneous processor mix in the switch enables other related functions to be undertaken and orders executed back onto the wire. Deployed in CoLo at the trading venues as part of the day to day mix of technology found in the racks today – this technology can take the design and performance of trading functionality to a higher level of performance.

Argon have quantified this "higher level of performance" by:

Using the test harness developed for the Finteligent Trading Community program, the latency measured was reduced by a factor of 25 over pure x86 designs tested by the program. For the measured leg in the test harness, latency was reduced from a previous best of 4,600ns to 176ns for algorithmically generated trades executed to the simulated market.

The enhancement in performance was achieved by providing a fast-path where trades are executed directly by the FPGA under the control of trigger rules processed by the x86 based functions . The latency is reduced further by two additional techniques in the FPGA – inline parsing and pre-emption.

As market data enters the switch, the Ethernet frame is parsed serially as bits arrive allowing partial information to be extracted and matched before the whole frame has been received. Then, instead of waiting until the end of a potential triggering input packet, pre-emption is used to start sending the overhead part of a response which contains the Ethernet, IP, TCP and FIX headers. This allows completion of an outgoing order almost immediately after the end of the triggering market feed packet. The overall effect is a dramatic reduction in latency to close to the minimum that is theoretically possible.

Here's a video Argon have produced showing their prototype system's performance being assessed using the Finteligent test harness:

If you listen carefully you will note that Argon are claiming that:

The switch makes market orders based on market information with end of packet to end of packet response times of about 170 ns.

According to that press release once again, Arista's Regional Director for Financial Services Paul Goodridge commented that:

This is exactly the kind of practical application we are looking to see from the market with our 7124FX product and we are delighted and impressed with Argon Design’s commitment and approach. This joint venture exemplifies Arista’s innovation and further highlights the real value of Arista’s EOS (Extensible Operating System) and its ability to take programmability to the Ethernet switching market.

I've now managed to speak to Paul, and I asked him about that programmability. As suggested by the 7124FX datasheet, EOS is essentially off the shelf x86 Fedora 14 Linux, but a good knowledge of Verilog will come in handy if you find you need to program the FPGA itself. When I asked about development systems Paul suggested a good first step would be to get hold of an Altera Stratix III or IV Development Kit, which are more readily available and also an awful lot cheaper than a 7124FX! In conclusion I asked Paul if there was anything he'd like to add to what he'd said in the Argon press release. He stressed:

Arista's focus on the empowerment of our customers, and the deterministic performance of our switches.

It seems that with a modicum of additional programming Arista's customers will soon be empowered to start deterministic high frequency trading at close to the speed of light! The only drawback is, of course, that the price of this sort of kit is fairly astronomical too.

[Update – Argon Design have kindly provided us with this white paper for you to read at your leisure]

Filed under Trading Platforms by ![]()

In a news release yesterday FXCM announced that:

Its U.S. subsidiary Forex Capital Markets LLC has agreed to assume the forex accounts of Alpari US LLC.

On Friday, September 27, 2013, accepted Alpari U.S. accounts will be transferred to FXCM U.S. after the close of trading.

After a detailed market review, Alpari selected FXCM because of their strong U.S. presence, financial stability, platform synergies and execution capability. Alpari U.S. clients will be transitioned from Alpari’s MetaTrader 4 (“MT4”) platform to the FXCM MT4 Platform and should see minimal changes in platform functionality. FXCM’s upgraded MT4 platform integrates seamlessly with its No Dealing Desk forex execution.

The deal affects all U.S. resident MT4 clients of Alpari US LLC.

Financial terms of the transaction were not disclosed.

At this time the Alpari U.S. web site remains strangely silent on the matter.

Filed under Brokers by ![]()

Following our recent report that FXCM had made an unsolicited offer to acquire GAIN Capital it looked likely that the GAIN board weren't very keen on that prospect. That perception was confirmed this morning when I received an email signed:

Gary Tilkin, CEO and President, Global Futures and Forex Limited.

Gary told me that:

I am writing with exciting news. Today, GFT and GAIN Capital Holdings, Inc. (NYSE: GCAP) announced that they have agreed to merge. The combination creates a larger, stronger company bringing innovation in trading technology and award winning customer service to our clients and partners.

Both GAIN and GFT have long and established histories in the online trading space, and together can leverage the best of breed in technology, service, dealing, and execution to create a new industry leader.

GAIN themselves express things slightly differently. In one press release this morning they said that:

The Board of Directors of GAIN Capital Holdings, Inc.(NYSE: GCAP), a global provider of online trading services, today announced that it has rejected an unsolicited written proposal from FXCM Inc. to acquire GAIN for 0.3996 shares of FXCM Class A common stock for each share of GAIN common stock.

The GAIN Board of Directors, with the assistance of its financial and legal advisers, has completed a thorough evaluation of the proposal, as well as a range of options to build shareholder value. Based on its evaluation, the Board has determined that pursuing the transaction proposed by FXCM would significantly undervalue the Company and its prospects and would not be in the best interests of the Company's shareholders at this time. The Board therefore unanimously rejected the proposal and reaffirmed its commitment to GAIN's strategic plan.

In a second press release they say that:

GAIN Capital Holdings, Inc. today announced that it has signed a definitive agreement to acquire Global Futures & Forex, LTD (GFT), a global provider of retail forex and derivatives trading with offices in London, Singapore, Tokyo, Sydney and Grand Rapids, Michigan. The purchase price is approximately $107.8 million which, including $80 million of GFT cash at closing, results in a net purchase price of $27.8 million. The purchase price will be paid with $40 million in cash, a five-year $40 million seller note and the issuance of approximately 4.9 million shares of GAIN common stock. Both companies will initially retain their separate brand identities, while benefiting from significant synergies and capabilities across their complementary businesses. The transaction is expected to close in the third quarter of 2013, subject to regulatory approvals and customary closing conditions.

Whether it's a "merger" or an "acquisition" it looks as though FXCM has a fight on its hands to deliver what it called at the start of the month:

The expected improvement of financial strength and stability of the combined entity.

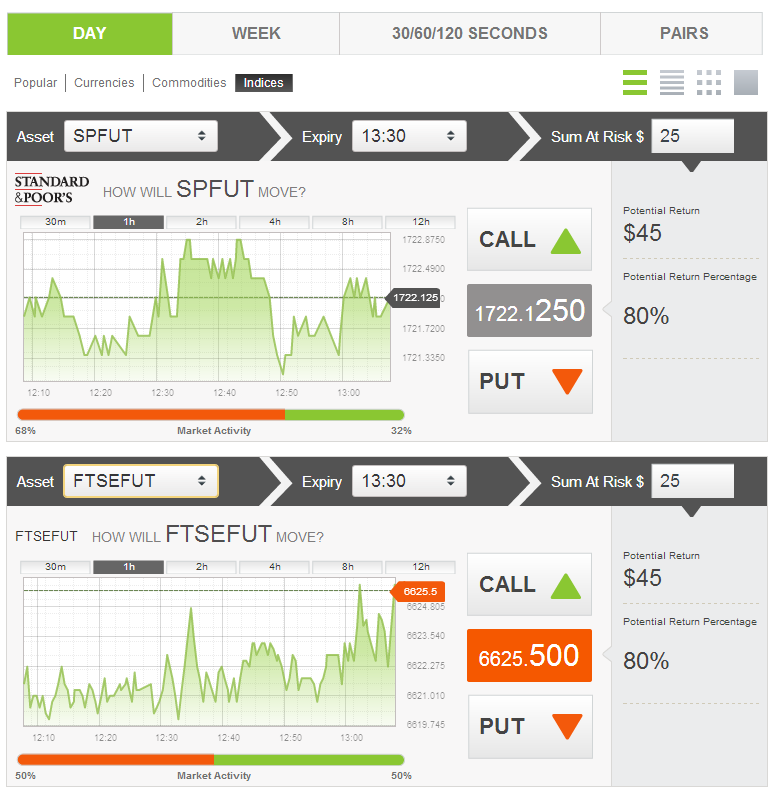

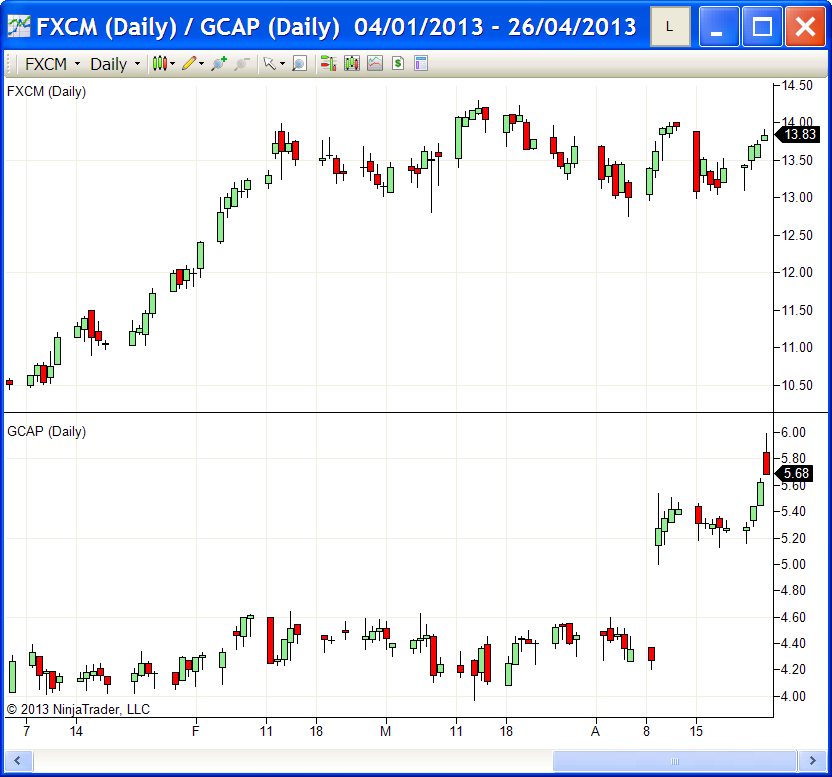

GAIN evidently has other ideas! Here's how the GCAP and FXCM share prices looked shortly after the market opened today:

Filed under Brokers by ![]()

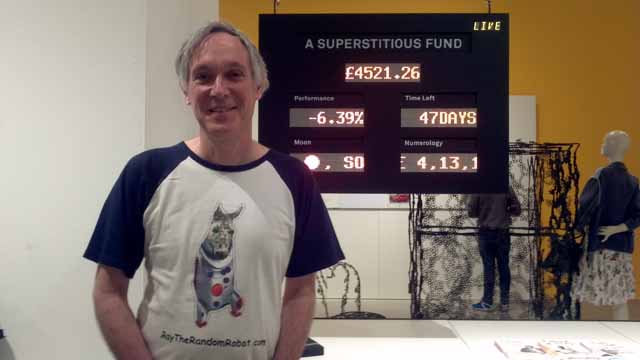

Sid is the Superstitious Robot and Ray is the Random Robot and they are cousins. They finally got to meet in person earlier this week thanks to Sid's appearance in the Designs of the Year 2013 exhibition at The Design Museum in London. Here's the undeniable proof:

Sid the Superstitious Robot is the "brains" behind Shing Tat Chung's Superstitious Fund, which was selected to appear in the digital category of this year's design awards. Sid and the Superstitious Fund didn't win the category unfortunately. That honour went to the new UK Government web site, which won the overall Design of the Year 2013 award too. In all the circumstances Sid wasn't too disappointed to lose out to a much better funded design.

Since Ray blew his entire (thankfully virtual) account recently I was pleasantly surprised to discover that Sid has actually been making some real profits recently spread betting on the FTSE 100 index, and with only 47 days left out of the 12 months the Superstitious Fund was designed to run his account was showing an overall loss of 6.3%, having been down over 10% after less than a month's trading back in June last year.

Just in case you're wondering about the design on the back of Ray's tee shirt here it is, elegantly modelled once again by yours truly:

None of the Design Museum staff passed comment on the tee shirt, but I did ask a couple of passers by to comment on Superstitious Sid's modus operandi after they had examined him closely. One felt it was:

A ridiculous way to try and make money from the markets!

whereas another thought it was:

An extremely interesting psychological experiment!

What's your take? Sid the Superstious Robot will remain on display at The Design Museum until July 7th if you'd like to take a closer look before deciding.

Filed under Trading Systems by ![]()