GAIN Capital "Merge With" GFT

Following our recent report that FXCM had made an unsolicited offer to acquire GAIN Capital it looked likely that the GAIN board weren't very keen on that prospect. That perception was confirmed this morning when I received an email signed:

Gary Tilkin, CEO and President, Global Futures and Forex Limited.

Gary told me that:

I am writing with exciting news. Today, GFT and GAIN Capital Holdings, Inc. (NYSE: GCAP) announced that they have agreed to merge. The combination creates a larger, stronger company bringing innovation in trading technology and award winning customer service to our clients and partners.

Both GAIN and GFT have long and established histories in the online trading space, and together can leverage the best of breed in technology, service, dealing, and execution to create a new industry leader.

GAIN themselves express things slightly differently. In one press release this morning they said that:

The Board of Directors of GAIN Capital Holdings, Inc.(NYSE: GCAP), a global provider of online trading services, today announced that it has rejected an unsolicited written proposal from FXCM Inc. to acquire GAIN for 0.3996 shares of FXCM Class A common stock for each share of GAIN common stock.

The GAIN Board of Directors, with the assistance of its financial and legal advisers, has completed a thorough evaluation of the proposal, as well as a range of options to build shareholder value. Based on its evaluation, the Board has determined that pursuing the transaction proposed by FXCM would significantly undervalue the Company and its prospects and would not be in the best interests of the Company's shareholders at this time. The Board therefore unanimously rejected the proposal and reaffirmed its commitment to GAIN's strategic plan.

In a second press release they say that:

GAIN Capital Holdings, Inc. today announced that it has signed a definitive agreement to acquire Global Futures & Forex, LTD (GFT), a global provider of retail forex and derivatives trading with offices in London, Singapore, Tokyo, Sydney and Grand Rapids, Michigan. The purchase price is approximately $107.8 million which, including $80 million of GFT cash at closing, results in a net purchase price of $27.8 million. The purchase price will be paid with $40 million in cash, a five-year $40 million seller note and the issuance of approximately 4.9 million shares of GAIN common stock. Both companies will initially retain their separate brand identities, while benefiting from significant synergies and capabilities across their complementary businesses. The transaction is expected to close in the third quarter of 2013, subject to regulatory approvals and customary closing conditions.

Whether it's a "merger" or an "acquisition" it looks as though FXCM has a fight on its hands to deliver what it called at the start of the month:

The expected improvement of financial strength and stability of the combined entity.

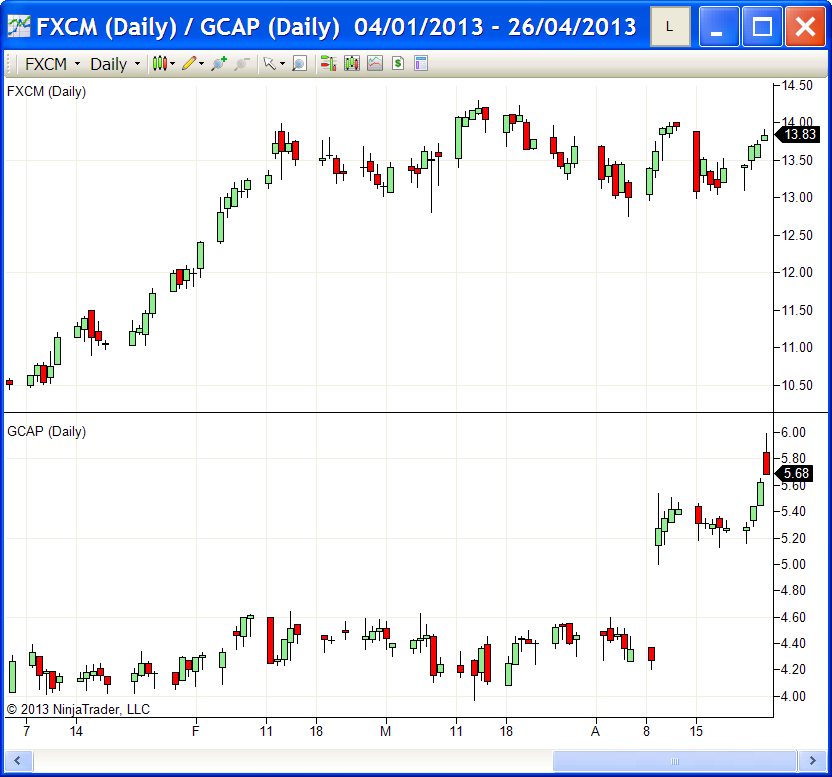

GAIN evidently has other ideas! Here's how the GCAP and FXCM share prices looked shortly after the market opened today:

Filed under Brokers by ![]()

Leave a Comment

Comments on GAIN Capital "Merge With" GFT

Following yesterday's announcement FXCM have had second thoughts about their offer to acquire GAIN Capital. In a press release last night they announced that:

Drew Niv, Chief Executive of FXCM, said that:

It's definitely good to see continued consolidation in the industry.

Hi Illimar,

So does that imply that Armada/Spada are hoping to be the target of further M&A activity by one of the big fish at some point in the not too distant future?

Jim