Just over a year ago we reported that "Microsoft Enters Retail Forex". It now seems as though what with one thing and another that little (ad)venture didn't turn out as originally hoped. At that time I opened an MSN Trader account of my very own, but yesterday I received an email from saxobank.com informing me that:

We write to inform you that the MSN Trader website will be de-commissioned very shortly and the normal log-in webpage will no longer be available.

As you are aware, your MSN Trader account is held and contracted with Saxo Bank A/S. Please be reassured that the services provided to you by Saxo Bank will remain unaffected. However, the log-in page to access your account will change. Going forward, the MSN Trader platform will adopt the Saxo Bank brand.

We thought we'd take one last look at the MSN Trader platform before it disappears forever. The good old MSN Trader home page is still there at the moment:

The "Investor Platform of the Future", always was "Powered by Saxo Bank", and soon the MSN Trader brand will be no more. Once logged in there is a noticeable absence of anything Microsoft. Instead there is an exhortation to try out the "new Saxo WebTrader docking system":

At the time MSN Trader was launched we also speculated about why Steve Ballmer had just sold $1.3bn worth of shares. This seemed like a perfect opportunity to check out what Microsoft shares have been up to over the last 12 months, and here's what the Saxo WebTrader Quick Chart for MSFT looks like:

As you can see, following a bit of drop this week it seems MSFT are back to almost exactly where they were a year ago. Maybe Steve really did decide that forex trading is more profitable than investing in Microsoft stock!

Filed under Brokers by ![]()

We reported at the beginning of November on the abrupt downfall of Jon Corzine. If you recall Mr. Corzine is an ex "Democratic" governor and senator, and now ex CEO of MF Global Inc. as well as an ex CEO of Goldman Sachs. He has just presided over the seventh largest bankruptcy in U.S. history. The Commodity Futures Trading Commission, one of the regulators supposedly keeping an eye on dodgy dealings on Wall Street on behalf of U.S. taxpayers, has released a long statement about the affair. Amongst other things CFTC Commisioner Scott D. O’Malia has this to say:

Segregation of customer funds is fundamental to our markets. The Commodity Exchange Act expressly prohibits intermediaries like MF Global from (i) commingling customer and proprietary funds (i.e., house funds) and (ii) using customer funds to support proprietary transactions. It appears that MF Global failed this fundamental responsibility.

In fact it seems as though the CFTC were failing in one of their fundamental responsibilities also, since what the law they are supposed to uphold "expressly prohibits" has happened anyway. Touching on that issue Mr. O’Malia has this to say:

More on The CFTC Finally Realize That MF Global "Has Shaken Public Confidence"!

Filed under Regulation by ![]()

I've just received an email which says it's from "Todd Crosland, President, IBFX Australia Pty. Ltd.". The email starts off by saying that:

As you may have already seen in the recently issued press release, IBFX Holdings, LLC has been acquired by TradeStation Group, Inc., a recognized leader in online trading and winner of Barron's 2011 "Best Online Broker" award. TradeStation is part of Monex Group, a leading Japanese online brokerage firm.

According to the TradeStation press release that Todd mentioned in his email:

Under the terms of the acquisition, which has been unanimously approved by the Boards of both companies, TradeStation Technologies, Inc., a wholly-owned subsidiary of TSG, acquired from Interbank FX, LLC, a Utah corporation and one of the wholly-owned operating subsidiaries of IBFX, the proprietary risk-management software of Interbank FX, LLC, and immediately thereafter TSG acquired all of the ownership interests of IBFX from its members. Within the next 30 days, Interbank FX, LLC (the primary Forex operating company of the IBFX group) will be merged into TradeStation Forex, Inc., a Retail Foreign Exchange Dealer registered with the Commodity Futures Trading Commission and a member of the National Futures Association, and, as a result, all of Interbank FX, LLC's accounts will be transferred to TradeStation Forex and it will be operated as the "IBFX Division" of TradeStation Forex. IBFX Australia Pty. Ltd. ("IBFXAU"), an Australian company regulated as a member of the Australia Securities and Investments Commission ("ASIC"), will also operate as a subsidiary of TSG.

It seems like recent speculation that Interbank FX was about to be sold was at least half right! Going back to Todd's email, he reassures IBFX Australia customers such as myself that:

You will naturally have some questions about how this announcement will affect you. We do not expect there will be any material changes to our products, services, management, spreads, fees, operations, systems or methods of doing business. In fact, we believe the acquisition will directly benefit every IBFX customer by combining our innovative approach to the FX industry with TradeStation's cutting-edge forex trading technology and support services.

So that's all OK then, and everbody's happy? As TradeStation put it:

This is a win-win for IBFX and TradeStation clients and makes TradeStation a global leader in forex trading, dramatically expanding our customer relationships and creating a global operating presence. IBFX's proprietary forex tools and services and its focus on customer care will now be backed by the financial stability and trading technology leadership of TradeStation. In time, TradeStation forex clients will benefit from technology offered by IBFX using TradeStation's award-winning, market analysis and trading platform.

A win-win situation for everyone concerned then, apart possibly from those investors in IBFX who for some reason aren't mentioned in any of the above announcements about win-win situations, but are mentioned in a document translated from the original Japanese on the website of the Monex Group, who themselves acquired TradeStation Group earlier this year?

Those investors would seem to be "Todd B. Crosland & Family (59%) and Spectrum Private Equity Fund (40%)". I wonder what they make of all this continued consolidation in global FX?

Filed under Brokers by ![]()

It's been in the pipeline for a long time now, but the Trading Gurus are now happy to announce that Ray the Random Robot™ has finally been ported to TradeStation's EasyLanguage. Ultimately this decision was prompted as much by the announcement of MultiCharts at LMAX, as by the prior arrival of TradeStation Forex and "TS for FX for free". Whilst EasyLanguage has been around for a long time and is in some respects the "industry standard", it's never before been readily useable by newcomers to automated trading with a limited amount of capital. Although it's still officially in beta testing, LMAX MultiCharts does promise to change that aspect of things for the better, as long as you're not a United States citizen! If you are a US citizen then I'm sure TradeStation FX will be happy to discuss opening an account with you!

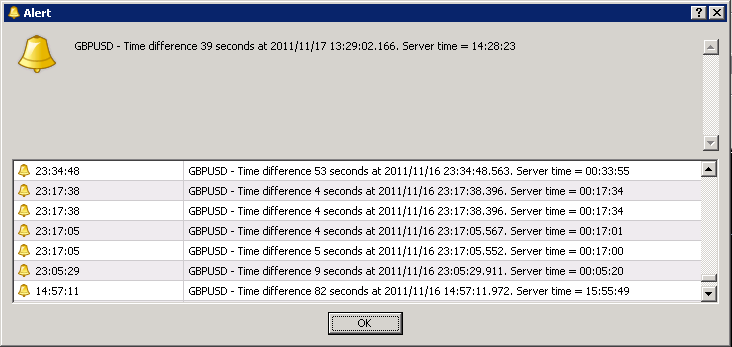

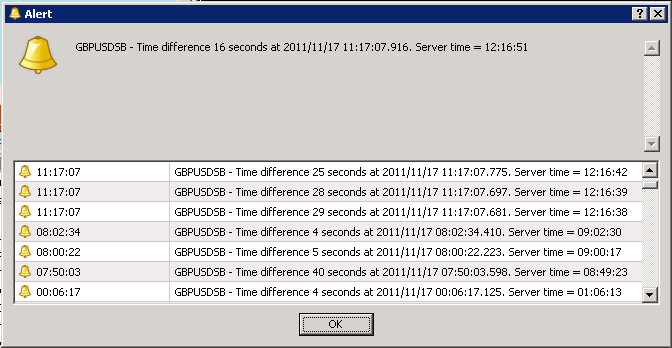

Wherever you were born, or currently reside for that matter, the newly minted source code of RRR for EZL is now available for download from the Trading Gurus Community forum. EasyLanguage does some things in a non-intuitive manner, if you're coming to it from another platform for the first time. If nothing else hopefully Ray's stupidly simple example will save someone from tearing out large quantities of their hair trying to work out why their stop orders seem to be getting ignored!

Filed under Trading Platforms by ![]()