Multi-Currency Backtesting with MetaTrader 5

One of the drawbacks of MetaTrader 4 has always been that whilst you can write a multi-currency expert advisor for the platform, the MT4 strategy tester only allows you to backtest one currency at a time. Now that the bugs in the MetaTrader 5 strategy tester are gradually being removed, we're just starting to use it for some serious testing.

In particular, since MT5 finally allows you to backtest multi-currency EAs, we've created a multi-currency version of our moving average crossover trading system. If you would like to experiment with this useful new feature of MetaTrader 5 you can download the source code from our community forum.

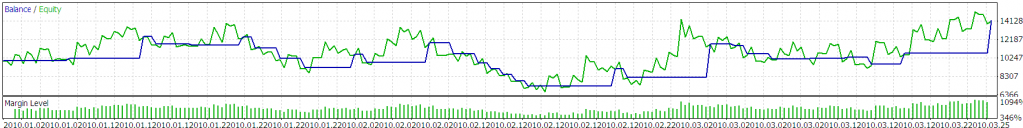

One of the advantages of diversifying a forex trading system across different currency pairs is supposed to be a smoother combined equity curve, so we put that theory to the test. First we backtested the single pair version of our moving average crossover system with the GBP/USD pair over the first 3 months of 2010. This was the resulting equity curve:

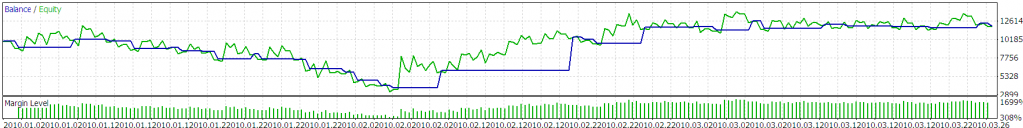

Then we did the same thing, but using AUD/JPY instead:

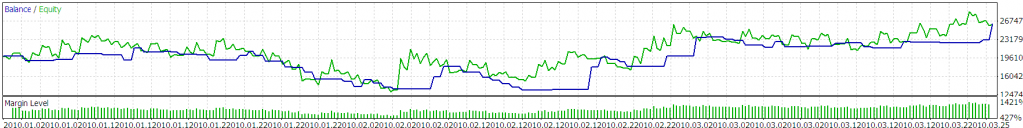

Finally we ran those two pairs through the multi-currency version of the EA, to reveal this combined equity curve:

The individual maximum equity drawdowns are 51.55% for GBP/USD and 71.71% for AUD/JPY. The maximum drawdown for the combination of the two is only 45.21%. Looks like there might be something in the theory that diversification is a good idea!

Filed under Trading Platforms by Jim ![]()

Leave a Comment