LMAX Trader Lets You "Make Your Own Market"?

Now that yesterday's excitement has died down a bit I had a chance this morning to chat to LMAX in greater detail about their new retail trading platform, recently christened LMAX Trader.

First of all note the following points extracted from the LMAX Trader Trading Manual:

We provide direct access to prices on instruments (for example, UK100 and GBP/USD) being offered on the LMAX multilateral trading facility (“the MTF”). You trade with us as principal and not as agent on your behalf on the prices we obtain on the MTF.

We process each order you place with us by placing an identical order (referred to as “our Back to Back Order”) on the MTF. Upon our Back to Back Order being matched by other traders or filled by a market maker on the MTF, we shall open or close a trade on the MTF (which is known as a “Back to Back Trade”). A trade will then be opened or closed on your account at the same price and in the same size as our Back to Back Trade. This is in essence how our trading service operates.

The prices on the MTF are constantly changing and we do not guarantee that the price you see when placing an order will be the price at which you trade is executed.

Our Back to Back Order submitted to the MTF will mirror the order that we have accepted from you. We cannot guarantee that our Back to Back Order will be matched or filled on the MTF. Our ability to open or close a trade on your account is entirely dependent on our ability to execute our Back to Back Order on the MTF. It is only when our Back to Back Order is matched or filled on the MTF that a trade will be opened or closed on your account Factors such as the quantity of your Order and liquidity available in the instrument you wish to trade will impact whether our Back to Back Order can be executed. It may therefore not be possible to open or close a trade on your account immediately.

It seems that the LMAX multilateral trading facility has been in beta testing for about 8 weeks, and was first made available to retail traders yesterday at the launch of LMAX Trader, which is the first (and currently only) broker member of the exchange. At the moment there are also three liquidity provider members, Optiver, J.P. Morgan and perhaps not surprisingly Goldman Sachs.

There is no demo platform available, so to give you a feel for things I've opened a live account of my very own with LMAX Trader. Although the minimum deposit is a mere £10, I've funded my new account with my customary £500, and I thought I'd take a stab at "making my own market". As a UK citizen I'm irrationally fond of Cable so I opened up a one minute chart:

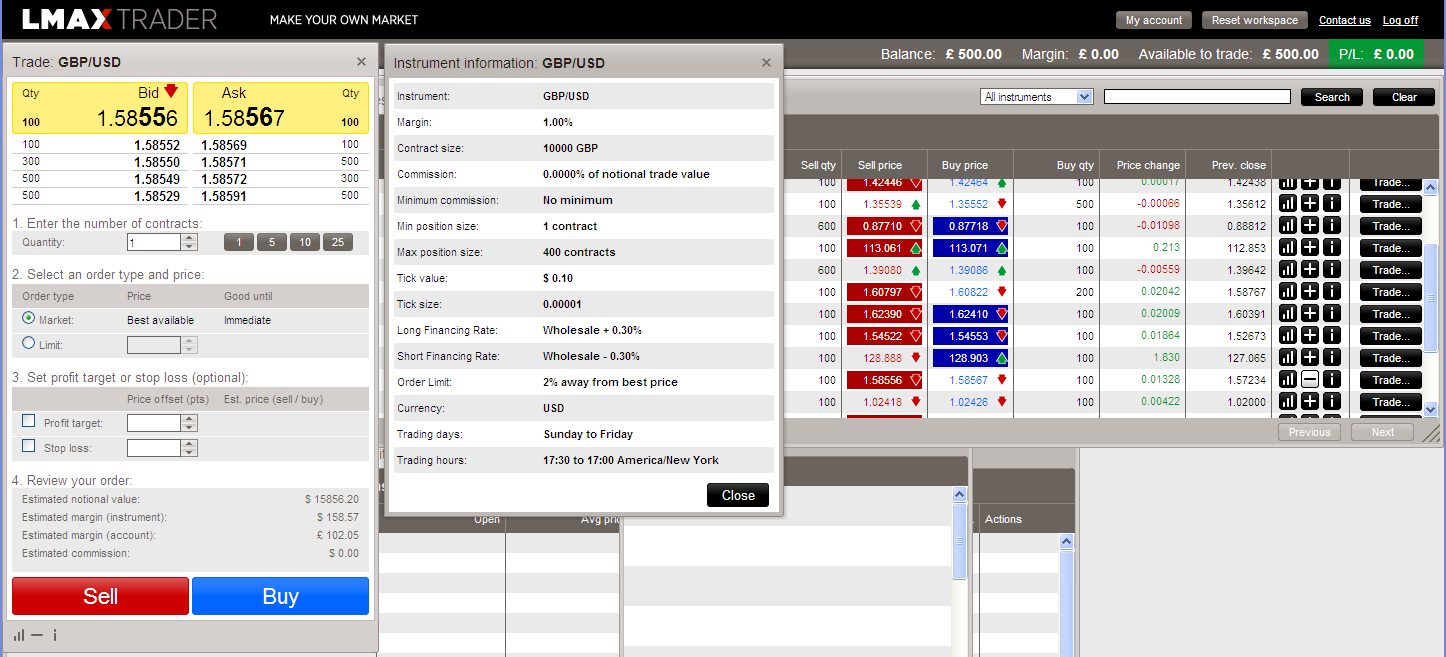

Then I opened up an order ticket, and also clicked the little "i" (for information) button at the bottom:

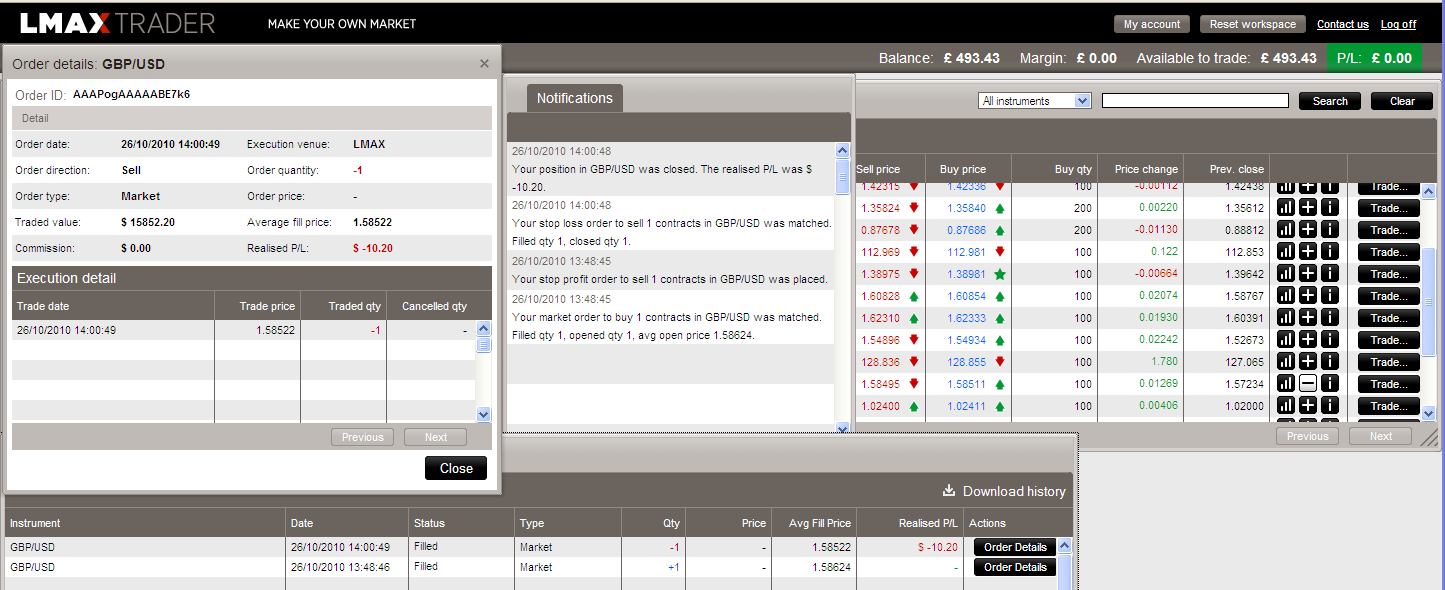

Since the minimum contract size is 10,000 GBP, and the leverage is 100 to 1, the platform helpfully pointed out that I'd be using around £102.05 margin per contract. I figured I'd better stick to just one. Just as well I put £500 into the account rather than the £10 minimum! I dialled in a 10 pip profit target and stop-loss and then tossed a coin. It came up heads, so I clicked the big blue "Buy" button. Unfortunately my luck was out today, and I eventually got stopped out:

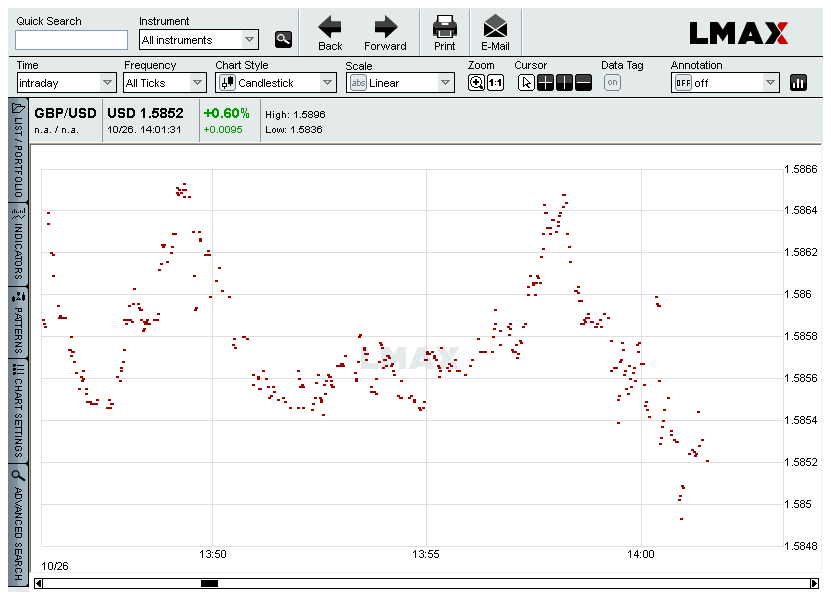

A tick chart provides more detail on the sorry story of my first ever LMAX Cable trade:

Now that I've given you plenty of clues, I'll leave it as an exercise for the interested reader to work out who profited from the £6.57 that my trusty two pence piece (TTPP for short) just lost me.

Filed under Trading Platforms by ![]()

Leave a Comment

Comments on LMAX Trader Lets You "Make Your Own Market"?

How is this called "making your own market" as LMAX like to call it? Where in the step to open a order can you "set your own price" ?!? It just seems to be like any other broker opening orders? (maybe have less liquidity)

Please could someone elaborate on how its different and "how to set your own price"?

Thank you!

Hi SSC,

The idea is that as a retail trader you can at least attempt to act like a market maker (if you really think that's a good idea!), and enter your own bids and offers onto the LMAX multilateral trading facility inside the current spread. In that sense you can "set your own price". LMAX also maintain that retail traders have a level playing field with the larger liquidity providers, in that the prices on their MTF are not "indicative", they are "tradeable".

As regards liquidity, it's still fairly early days for LMAX. The best I can suggest is that you experiment with a live account and see if the liquidity that's available is sufficient for your requirements. Alternatively I feel sure LMAX would be happy if you wanted to add some of your own!

Cheers,

Jim

Hello Jim,

Thanks, but i still dont fully understand. Please could you give a short example of how "to set own price" if the current SPOT of GBPUSD is 1.6090? How do you mean inside the spread?

Is it like i can say that i want a bid of 1.6095? But isnt that the spread that brokers put in?

Thanks again.

Hi SSC,

This is getting a bit complicated for a blog comment. I've created a new thread over on our community forum that goes through the mechanics of how to "make your own market" at LMAX.

If you have any further questions on this topic could you please ask them over there?

Thanks,

Jim