Fresh from having their UK subsidiary fined by the CFTC earlier this month, FXCM have now been fined $2 million by the National Futures Association. Once again the complaint against FXCM and their CEO Drew Niv and details of the agreed settlement have been published simultaneously. Once again FXCM neither admit nor deny the allegations in the complaint, which concern FXCM's failure to pass on positive slippage from their liquidity providers to their customers, and lapses in their anti money laundering procedures. However this time around FXCM's customers do stand to benefit financially since one of the agreed sanctions states that:

Within 30 days of the effective date of this decision, FXCM shall make a good faith effort to credit the accounts of its customers the amount of positive slippage which its customers experienced on their trades from and after June 18, 2008

Filed under Regulation by ![]()

AlgoTrader today announced a new open source algorithmic trading platform. AlgoTrader is an automated trading system that can trade any type of security on any market available through Interactive Brokers and/or the FIX protocol (real soon now!). All aspects of trading such as obtaining market data, analyzing prices, taking trade decisions, placing orders & tracking executions can be automated. The new platform uses the Esper complex event processing engine, and is based on Java SE 6.0, Spring, and a Model Driven Architecture.

An initial version of AlgoTrader is now available Open Source at http://code.google.com/p/algo-trader/

Features of the system include:

- Automates trading strategies based on trading rules (using Esper EPL)

- Automated execution via different broker interfaces

- Backtesting and simulation of trading strategies based on historical data

- Portfolio tracking & performance measurement

In the interests of transparency I should point out that I'm a member of the AlgoTrader development team. If you are interested in contributing to the project too then please get in touch.

Filed under Trading Platforms by ![]()

Last October we wondered what steps the CFTC would be able to take to enforce the new forex trading regulations that had just come into force, particularly when it came to pursuing offshore brokers in offshore courts. Back in January they sued a few brokers using the US courts. Now they have used a different approach, which still hasn't required the CFTC to state their case in a foreign jurisdiction. It seems all they need to do is to ask nicely for some money!

The CFTC has just announced that it has:

Filed and simultaneously settled charges that Forex Capital Markets Ltd. (FXCM Ltd.) of London, U.K. acted as a retail foreign exchange dealer (RFED) by conducting retail leveraged forex transactions with U.S. customers without registering with the CFTC under the agency’s regulation 5.3(a)(6)(i). FXCM Ltd. has never been registered with the CFTC in any capacity.

The CFTC order requires FXCM Ltd. to pay a $140,000 civil monetary penalty and to cease and desist from further violating CFTC regulation 5.3(a)(6)(i).

According to the CFTC order instituting proceedings:

The Commodity Futures Trading Commission ("Commission") has reason to believe that from October 18,2010 to October 29, 2010, Forex Capital Markets Ltd. ("FXCM Ltd." or "Respondent") violated Commission Regulation 5.3(a)(6)(i), to be codified at 17 C.F.R.§ 5.3(a)(6)(i). Therefore, the Commission deems it appropriate and in the public interest that public administrative proceedings be, and hereby are, instituted to determine whether Respondent engaged in the violation set forth herein and to determine whether any order should be issued imposing remedial sanctions.

Whether in the public interest or the interest of their shareholders FXCM seem to have thought it was prudent to settle this issue without getting as far as a court in either the US or the UK. According to the CFTC order once more:

In anticipation of the institution of an administrative proceeding, Respondent has submitted an Offer of Settlement (the "Offer"), which the Commission has determined to accept. Without admitting or denying any of the findings or conclusions herein, Respondent consents to the entry of this Order Instituting Proceedings Pursuant to Sections 6(c) and 6(d) of the Commodity Exchange Act, As Amended, Making Findings and Imposing Remedial Sanctions ("Order") and acknowledges service of this Order.

Nothing's been admitted or proven, but FXCM UK have agreed to become a bit poorer, and the US authorities a bit richer. How is any of this in the interests of the members of the US public who allegedly placed some trades via FXCM UK during those 11 days last October?

Filed under Regulation by ![]()

In a press release yesterday Saxo Bank announced that their ForexTrading.com web site not only provides some forex trading education. It now also allows you to trade spot forex and CFDs:

Saxo Bank, the online trading and investment specialist, today announced the launch of ForexTrading.com which will offer retail investors a select range of FX crosses and CFDs with variable spreads – as low as 0.8 pips.

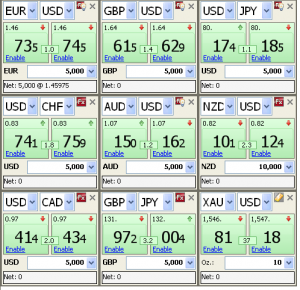

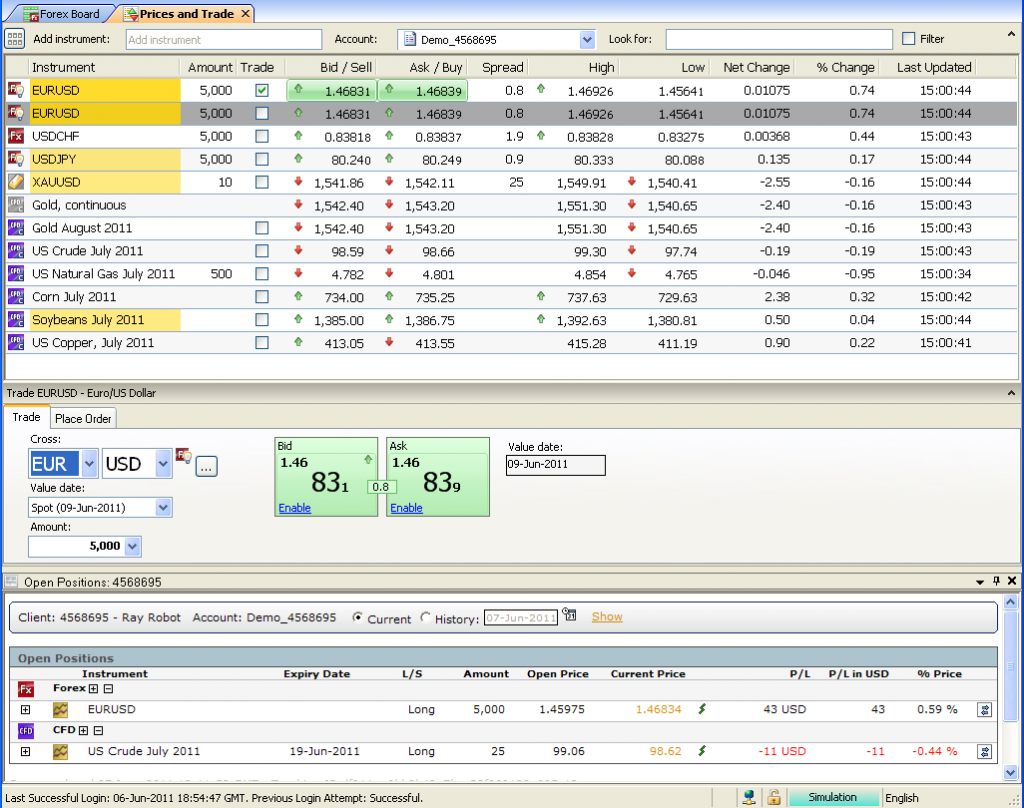

Those spreads are not only variable, they are also significantly smaller than the spreads available to Saxo's existing retail clients through the SaxoTrader and WebTrader platforms. Here's a quick comparison between two demo accounts, with the new ForexTrading.com first:

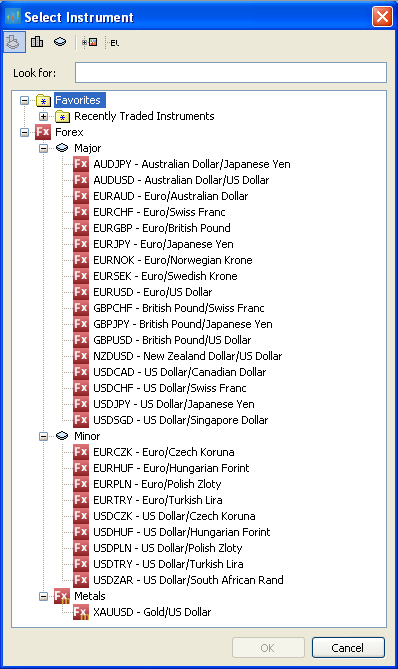

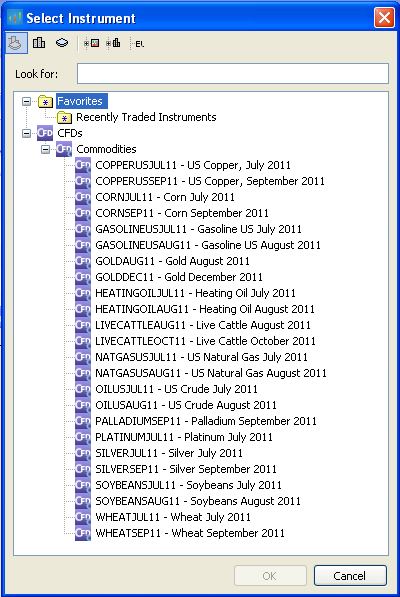

Something else that has reduced is the minimum initial deposit, which is down to $2,000 for the new accounts. Obviously there is a price to be paid for these benefits. You trade using cut down versions of SaxoTrader and/or WebTrader, which only allow you access to a limited selection of the most liquid FX pairs (both spot and forward) and commodity CFDs:

If you want to trade stocks, futures or options you'll still need a "classic" Saxo account. If you can live without those instruments however, on a ForexTrading.com account all communications will have to be in English, and trading is not available via telephone. The new accounts have to be funded by wire transfer initially, but after that instant top-ups using debit or credit cards are available. That might come in handy, since leverage on the most liquid pairs can go as high as 1:200! You might well infer from that fact that these new accounts are not available to citizens of the United States, and you would be correct to do so.

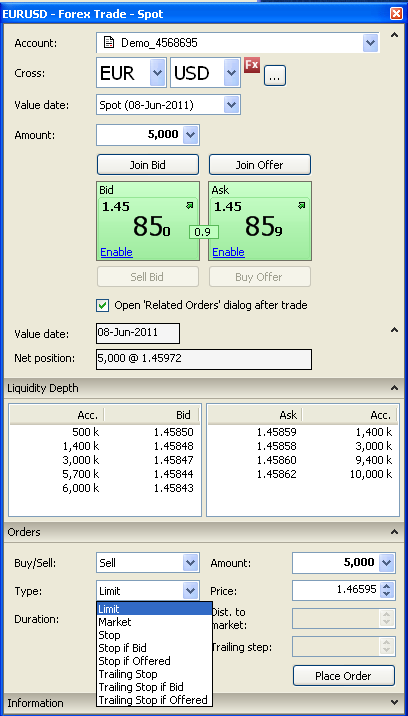

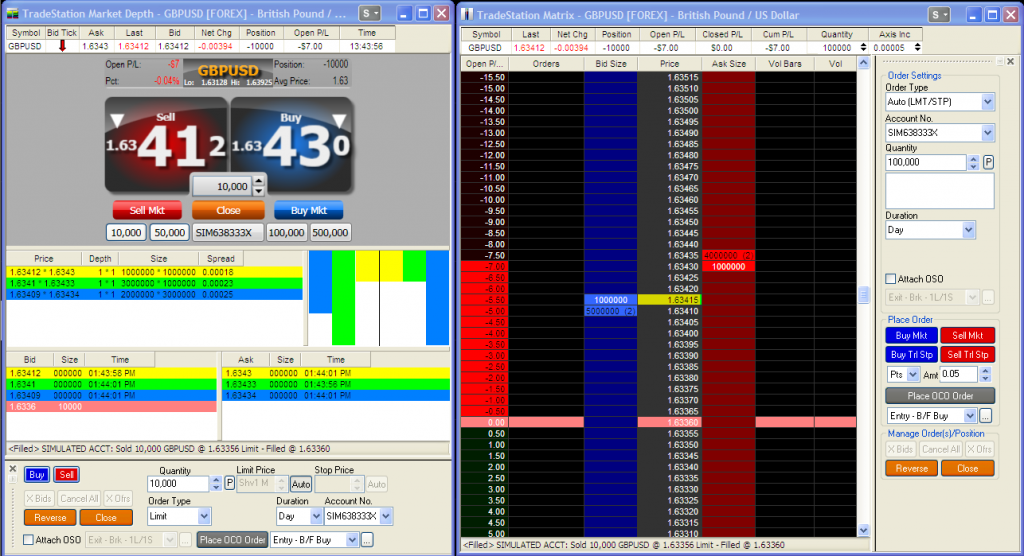

Assuming you're not from the U.S. and you've funded your account there are a numbers of ways of placing a trade, but all of them are manual! Once upon a time Saxo did support automated trading via Trade Commander, but not any more it seems. We took a look at Saxo's Web Trader platform when MSN Trader was launched, so for now we're going to concentrate on the desktop platform. Here's a view of an FX order ticket:

As you can see there are a variety of ways of entering a variety of order types, and on FX at least market depth information is made available to you. Minimum order size for forex is 5,000 – midi lots I suppose?

If all that information seems like it's too much to handle, you can look at a table of your favourite instruments instead:

If you click the little "Trade" check box the quotes turn into green buttons, and you can perform a one click trade by just clicking one of them. Note too that "Gold" is available either as spot "FX" or as a futures style CFD complete with expiry date. That no doubt explains why the "Value Date" box which allows you to select a forward date for FX pairs is grayed out for gold. Along with the other commodity CFDs, there is also a "continuous" version of gold of the sort familiar to futures traders. This merges the different contract expiries into a single set of data that can be charted and/or analyzed without any sudden jumps at expiry, but can't be traded.

There you have our first quick impressions of Saxo Bank's new retail brokerage offering. It looks like it's going to be worth a very close look at a practice account if you're happy trading manually and you have in your possession at least $2,000 you're willing to lose. However if you're into automated forex trading like us, or you're from North America, unfortunately you'll need to look elsewhere. As things stand at the moment ForexTrading.com isn't going to see off MetaQuotes.net just yet.

Filed under Brokers by ![]()

We suggested just after Christmas that FXCM were building an acquisitions war chest, and that's how things are now starting to pan out. At the beginning of this month the Wall Street Journal reported that:

FXCM had agreed to buy the retail trading business of GCI Capital of Japan, adding 20,000 active accounts to the online foreign exchange broker.

Now FXCM have announced in a press release that the deal has been finalized:

FXCM has acquired the retail FX business of GCI Capital Co. Ltd of Japan for $5 million net of cash received, subject to certain adjustments. GCI Capital's retail FX business, which has been operating under the FXCM Japan brand, will provide an excellent complement to FXCM's recent purchase of ODL Japan. The two entities will combine and operate as FXCM Japan, under the FXCM Inc umbrella.

We also suggested not long ago that more forex lawsuits were on the cards, and FXCM has been on the receiving end of another one this month. According to Michael Greenberg at Forex Magnates an analyst's downgrade after FXCM's recent IPO on top of that first lawsuit led to a fall in FXCM's share price, which in turn led to a securities class action lawsuit against FXCM.

Filed under Stock Trading by ![]()

That prescient title is a quotation from a presentation given by Professor Dave Cliff of the University of Bristol at the Innovation and Algorithmic Trading conference hosted by LMAX at University College London at the end of February. I was sat at the front throughout Dave's talk, and I found myself laughing frequently. Perhaps for that very reason any shots of the back of my head have been left on the cutting room floor in the videos that have just been made available on the LMAX Trader community website. Here's Dave's extremely interesting and even more amusing presentation from that event on the subject of "Robot traders and evolving markets":

Here are Dave's take aways (at around 27:00) to try and tempt you to watch the whole thing from start to finish. You won't regret it, I promise!

- Algorithmic trading is here to stay

- Human traders are an endangered species

- Machine optimised algorithms are the future

- The global financial markets are a large scale complex IT system

- A wind tunnel is a useful thing… but it tells you nothing about whether Gower Street will be congested at 5 PM

- We need system level simulations too

Here's the UK Government project that Dave refers to at the end of his talk – Foresight Project on The Future of Computer Trading in Financial Markets and here's why he thinks it's important:

As far as I know no one has a tool for measuring tail risk at the systemic level (32:45)

That is no joke!

Filed under Trading Systems by ![]()