Swiss Franc Surprise Causes FXCM a Big Problem

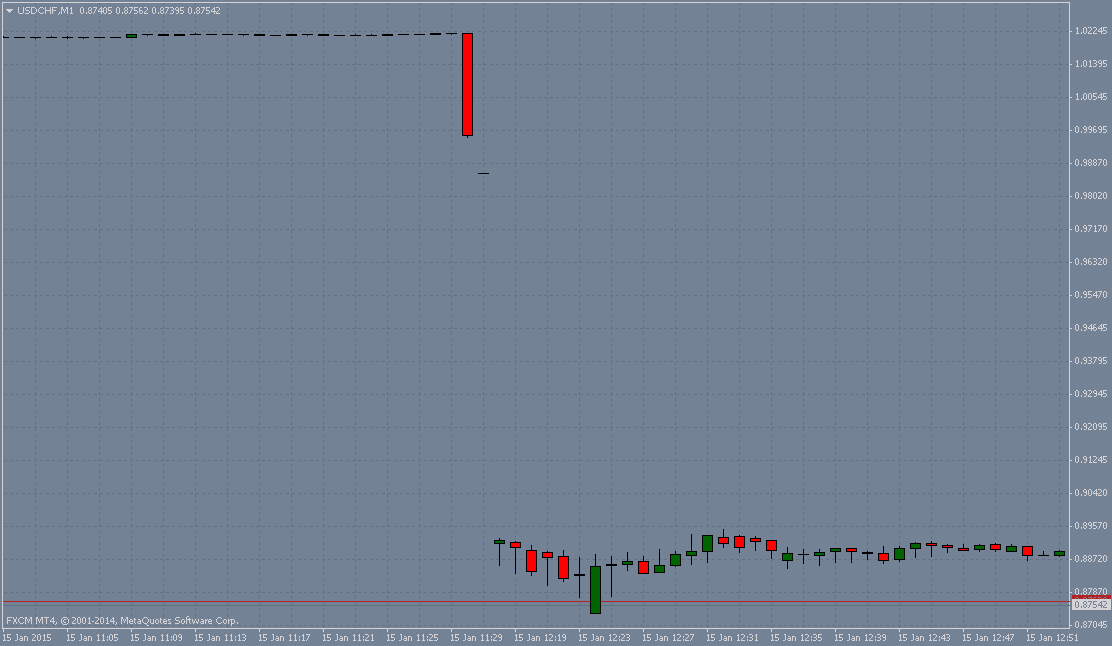

First of all, here's a screenshot from FXCM's flavour of MetaTrader 4 on January 15th 2015 :

The cause of the big gap was the following announcement from the Swiss National Bank at 9:30 GMT this morning:

The Swiss National Bank (SNB) is discontinuing the minimum exchange rate of CHF 1.20 per euro. At the same time, it is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold by 0.5 percentage points, to −0.75%. It is moving thetarget range for the three-month Libor further into negative territory, to between –1.25% and−0.25%, from the current range of between −0.75% and 0.25%.

Shortly after the surprisingly sudden descent of the Swissie FXCM issued a press release, which reads as follows:

FXCM (NYSE:FXCM) an online provider of forex trading and related services worldwide, announced today due to unprecedented volatility in EUR/CHF pair after the Swiss National Bank announcement this morning, clients experienced significant losses, generated negative equity balances owed to FXCM of approximately $225 million.

As a result of these debit balances, the company may be in breach of some regulatory capital requirements.

We are actively discussing alternatives to return our capital to levels prior to today's events and discussing the matter with our regulators.

So much for the benefits of "No Dealing Desk"?

Comments on Swiss Franc Surprise Causes FXCM a Big Problem

Perhaps not unsurprisingly FXCM's shares on the New York Stock Exchange have taken a bit of a tumble:

Note that according to the NYSE web site trading in FXCM's shares is currently suspended, with a bid/ask of 1.47/1.50. Compare that to yesterday's last price of $12.63 and a 52 week high of $17.97.

According to Bloomberg:

It has been announced in a press release that:

Jefferies Group LLC is a subsidiary of Leucadia National Corporation.

FXCM shares are trading on the NYSE once again today. Here's how the 5 day chart looks at the moment: