Due Diligence in the City of London

You are probably aware by now that the latest regulatory changes proposed by the CFTC, and in particular the reduction of retail forex leverage to 10 to 1, have caused a lot of consternation in the forex industry, to say the least! I anticipate that one side effect of the new rule will be that even more money will very soon be winging it's way from the United States over the Atlantic to the United Kingdom. If you are, or hope soon to be, a profitable forex trader then you really do need to start considering whether to send your hard earned moolah in this direction too.

Before you do that though think about this. Did you know that FOREX.com is actually Gain Capital Group LLC for example? If you did know that did you automatically assume that Gain Capital Ltd. was behind FOREX.com in the UK, and regulated by the FSA? If so think again!

I have always advocated "Doing Your Own Research" where money is concerned. Sending your cash offshore is fraught with dangers, and I today I'd like to help you do your own due diligence on (supposedly!) UK based brokers regulated by the Financial Services Authority (or FSA for short). In the UK a brokerage will be incorporated as a "Limited Company", and the company name will finish with the word "Limited", frequently abbreviated to Ltd. All such companies have to send their paperwork every year to Companies House. If they don't do it on time they get fined. If they leave it too much longer all sorts of other unpleasant thing can be done to the officers of the company, known as directors. This paperwork includes amongst other things the company accounts, and director and shareholder details.

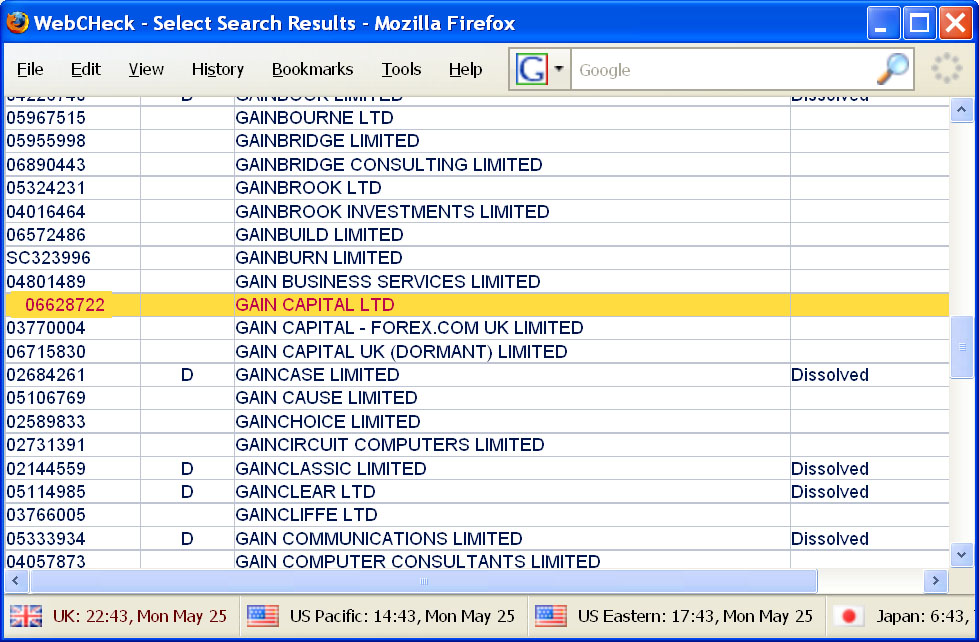

Companies House also thoughtfully provide a service called WebCHeck which allows you to read all this (by now virtual) paperwork. Some is free of charge. some you have to pay a pound a pop for. They are happy to take your credit card number! To access this amazing feast of information go to http://www.companieshouse.gov.uk/info and type the name of the brokerage you are interested into the "Company Name" box, then click the "Search" button. Here's one I did earlier:

Search results for "Gain Capital" at Companies House

The website highlights in yellow their best guess for the company you're searching for. Whether they are right or wrong just click the number of the brokerage you're interested in and all sorts of interesting things will be revealed to you. At this stage make sure to note down the full name of the company, the company number and the last line of the address, which is the postcode (the UK version of a zip code) of the company's registered office. If you note down any dates as well please bear in mind that us Brits write dates in a strange fashion. We do it day/month/year, so 7/4/2009 is not what you're thinking, it's the 7th of April!

The eagle eyed amongst you will have already noticed that I didn't choose this example entirely at random. Which of the three Gain Capitals should you click on? I strongly suggest all three. That way you have a fighting chance of working out which one will be looking after your pile of dollars when they eventually land in London, exhausted after their arduous journey across the pond.

Next click on the link that says "Order information on this company" over on the right hand side. That will take you to a page that provides lots more nuggets of free gold, as well as the chance to purchase more detailed information. At this stage please note carefully the following Companies House disclaimer:

Companies House is a registry of corporate information. We carry out basic checks to make sure that documents have been fully completed and signed, but we do not have the statutory power or capability to verify the accuracy of the information that corporate entities send to us. We accept all information that such entities deliver to us in good faith and place it on the public record. The fact that the information has been placed on the public record should not be taken to indicate that Companies House has verified or validated it in any way.

To put it in plain English – "If the bar stewards are economical with the truth to us, we just pass their lies on to you"

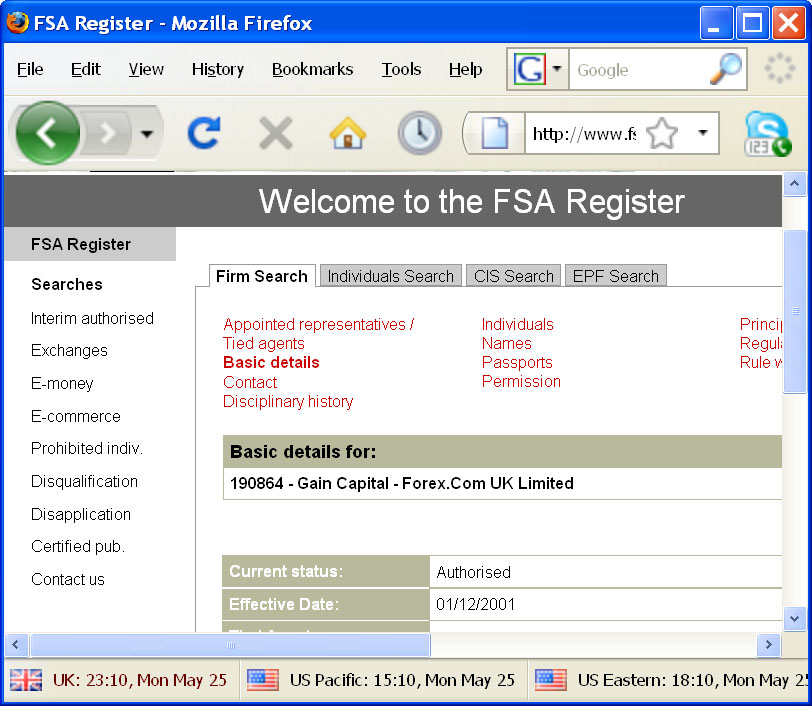

Fear not though. The Financial Services Authority itself will come to the rescue! Head over to their website at http://www.fsa.gov.uk/register/firmSearchForm.do. At the bottom of the page is a box entitled "By Name and Post code". For now just type in the company name then click the "Submit" button. Most of the time this will work fine, but if you have problems you can come back later and try searching using the postcode too. Here's what I found:

Search results for "Gain Capital" at the Financial Services Agency

Looks like there's only one Gain Capital authorised by the FSA. Better make sure that they are the one that's going to be caring for your greenbacks! Now go and explore the red links near the top of the window. I hope for your sake that "Disciplinary history" is blank. Check out the "Individuals" and "Names" pages too, not forgetting to click the link that reveals any previous names. Seems like Gain Capital wasn't always merely the UK arm of FOREX.com doesn't it:

Finally Google those assorted company and individual names. Find anything interesting?

So there you have it. A beginners guide on how to tiptoe through the minefield that is investing offshore in the UK. Subscribe to our RSS feed or sign up for our course to make sure you continue to receive our bulletins about how to survive the momentous changes that will continue to take place in the online forex trading industry worldwide over the coming months.

Filed under Brokers by ![]()

Leave a Comment

Comments on Due Diligence in the City of London

It is a very good idea to do such a research first before you trust others not only with your money.

Thanks for the tips

Hi Kasia,

You're absolutely right! It's vital to DYOR before sending your hard earned money to ANY broker, but especially one that's overseas.

As soon as time allows we'll cover this process in a bit more detail, and for other jurisdictions.

Jim

Listen, I would just go straight away to Dukascopy SWFX.

And not worry excessively about these things.

Currently, I have two accounts. One at FXCM UK

and one at Dukascopy SWFX. If something unforseen

occurs at FXCM UK, I will just go completely to Dukascopy.

Have an exit plan as well in addition to doing your own

research.

Hi Jon,

Thanks for all your recent comments!

Here at the Trading Gurus we also have live accounts at FXCM UK and Dukascopy SWFX, and a few other brokers too. We are very fond of brokers that offer an API, but are not limited to MetaTrader 4.

You need to be a bit careful over weekends with Dukascopy. Apart from the ever present danger of gaps to your own account, they reduce leverage to 30 to 1 to reduce their own exposure to unanticipated events whilst the markets are closed.

As you so rightfully point out, always DYOR and always draw up contingency plans!

Cheers,

Jim

Great article Jim. I didn't know about the FSA register, so that's very useful.

P.S. As I'm sure you're aware, the Brits use the correct date format, it's North Americans (mostly) that do it strangely 🙂

http://en.wikipedia.org/wiki/Date_and_time_notation_by_country