CitiFX Pro Launched in the United Kingdom

Citi announced in a press release earlier this week that us poor souls from the UK would have to wait no longer to be able to use the CitiFX Pro platform. According to Citi’s Manager of Margin Foreign Exchange for Europe and the Middle East, Sasha Serebrinsky:

The UK launch of CitiFX Pro offers UK-based clients all of the advantages of trading FX through a global leader, including excellent liquidity and access to its highly regarded research and market commentary. We offer experienced individuals and small institutions a flexible product with tight pricing, which could make a difference to our clients’ bottom line.

Here at the Trading Gurus we're into automated trading that completely ignores "the fundamentals" and doesn't make a whole lot of use of standard technical analysis either, so the research and market commentary isn't of much interest to us, however highly regarded it might be by others. Access to "excellent liquidity" most certainly is of interest though. The first catch is that before you can discover how big a difference all that lovely liquidity might make to your bottom line in practice you have to be able to stump up at least £7,500, and satisfy the FSA's definition of a "professional client" as required by the MiFID legislation. Assuming you can do that Citi will let you loose on one of their four available trading platforms. However if you're into automated trading as we are you need to be more than a mere "professional" if you want to use anything better than MetaTrader 4 as your API. If you want access to Citi's alternative FIX API you need to be "an institution".

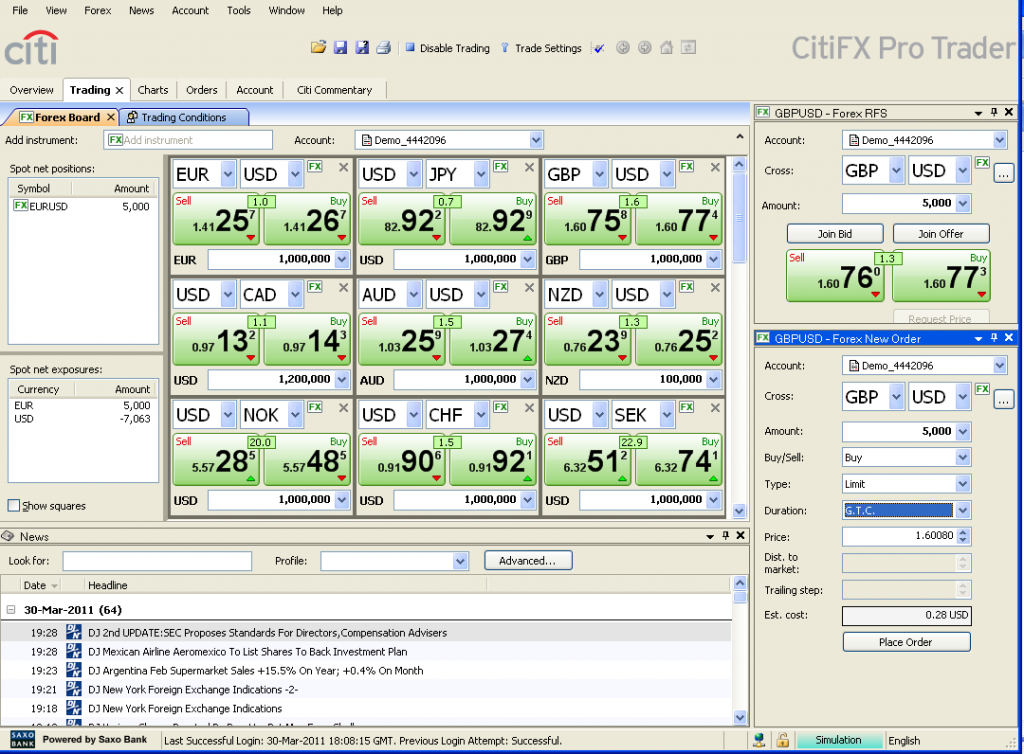

If you're merely interested in manual trading however, then your £7.5 grand up front will get you access to the CitiFX Pro platform. That comes in 3 flavours – desktop, mobile and web. The technology is actually supplied to Citi by Saxo Bank, and so the web platform is very similar to the MSN Trader platform that launched at the end of last year. Here's a quick look at what the desktop client looks like:

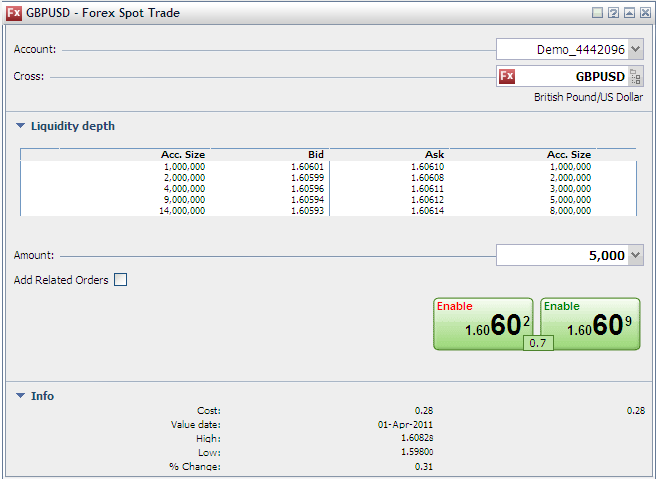

The slightly surprising thing for a "professional" platform is that it doesn't provide you with depth of market information. MetaTrader 4 doesn't either of course so you'll need to fire up the WebTrader platform to check that out. Here's how that "excellent liquidity" looks on an order ticket for Cable at the moment:

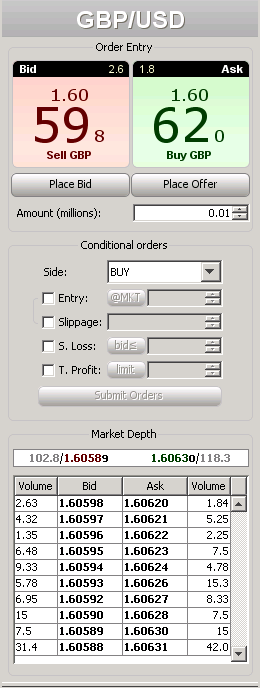

Note that the screenshot is of Citi's demo platform, although they assure me it is fully representative of what I would see on a live account. Note too that for comparison purposes here we are simulating an account funded with at least £30,000 to reveal Citi's tightest spreads. That means on a live account we'd be paying commission as well. Over here in Europe one of Citi's biggest competitors in the professional spot forex arena is Dukascopy Bank. Here's what a GBP/USD order ticket looks like on their JForex platform as we speak:

Which do you like the look of most?

Tags: API, Citi, DoM, FIX, Forex Brokers, FSA, Liquidity, MetaTrader, MiFID, Sasha Serebrinsky, Saxo Bank

Leave a Comment