Saxo Bank Relaunch ForexTrading.com as a Retail Forex Broker

In a press release yesterday Saxo Bank announced that their ForexTrading.com web site not only provides some forex trading education. It now also allows you to trade spot forex and CFDs:

Saxo Bank, the online trading and investment specialist, today announced the launch of ForexTrading.com which will offer retail investors a select range of FX crosses and CFDs with variable spreads – as low as 0.8 pips.

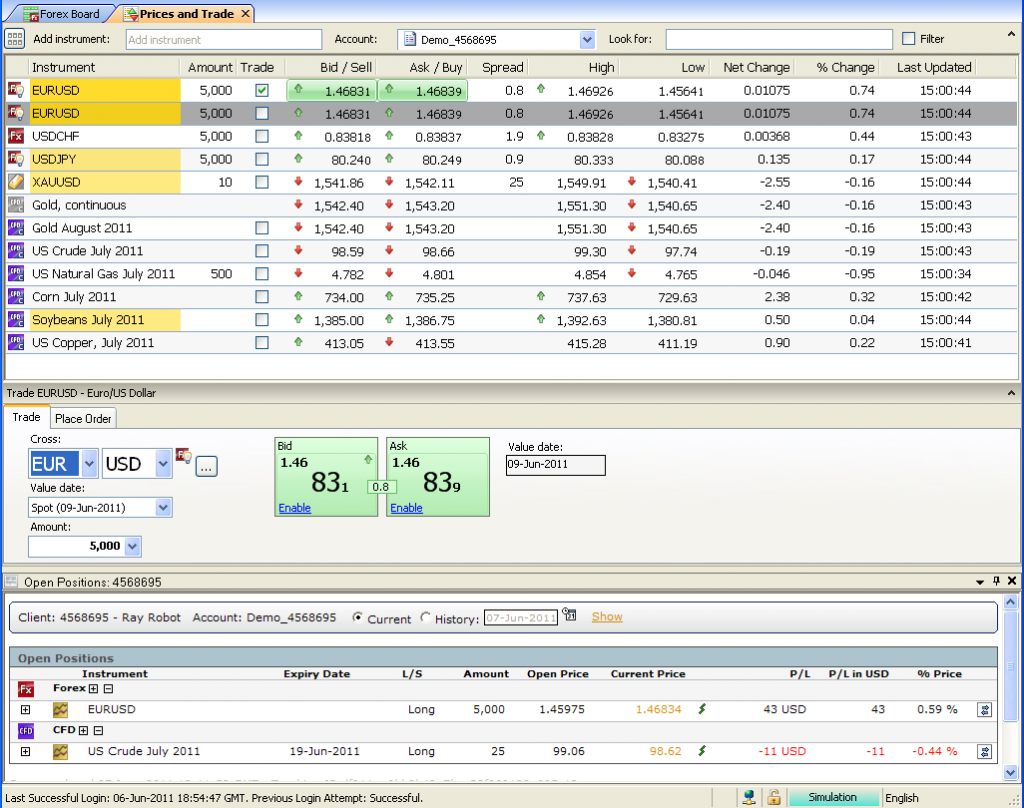

Those spreads are not only variable, they are also significantly smaller than the spreads available to Saxo's existing retail clients through the SaxoTrader and WebTrader platforms. Here's a quick comparison between two demo accounts, with the new ForexTrading.com first:

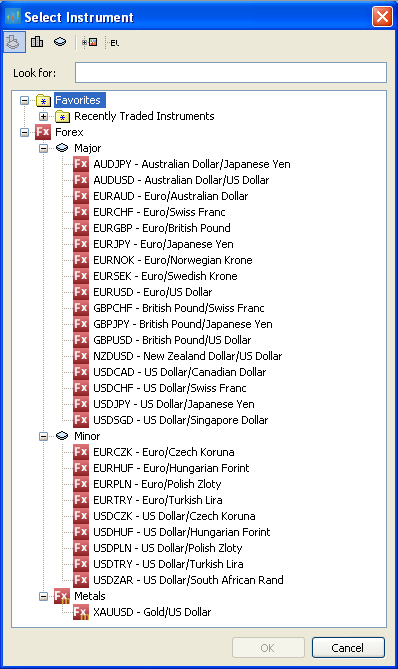

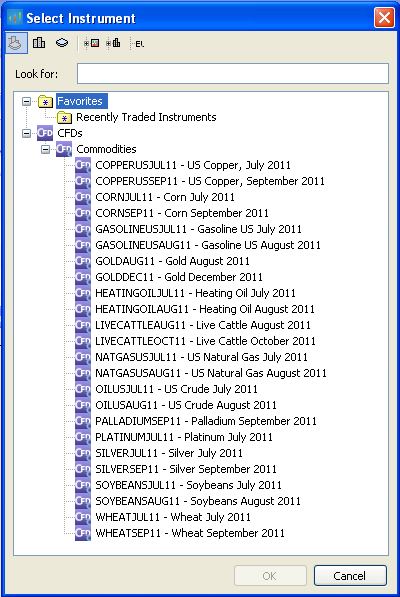

Something else that has reduced is the minimum initial deposit, which is down to $2,000 for the new accounts. Obviously there is a price to be paid for these benefits. You trade using cut down versions of SaxoTrader and/or WebTrader, which only allow you access to a limited selection of the most liquid FX pairs (both spot and forward) and commodity CFDs:

If you want to trade stocks, futures or options you'll still need a "classic" Saxo account. If you can live without those instruments however, on a ForexTrading.com account all communications will have to be in English, and trading is not available via telephone. The new accounts have to be funded by wire transfer initially, but after that instant top-ups using debit or credit cards are available. That might come in handy, since leverage on the most liquid pairs can go as high as 1:200! You might well infer from that fact that these new accounts are not available to citizens of the United States, and you would be correct to do so.

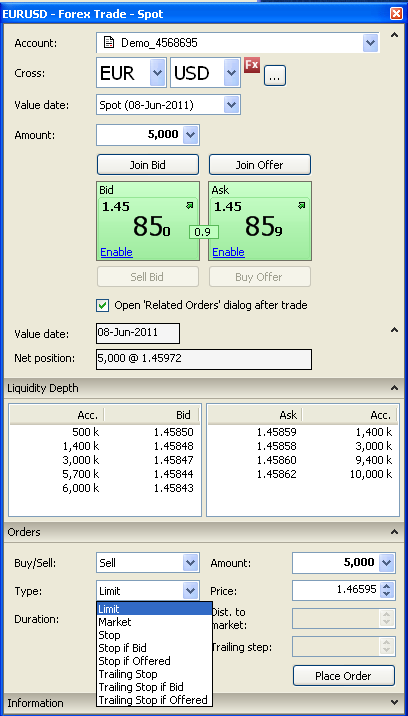

Assuming you're not from the U.S. and you've funded your account there are a numbers of ways of placing a trade, but all of them are manual! Once upon a time Saxo did support automated trading via Trade Commander, but not any more it seems. We took a look at Saxo's Web Trader platform when MSN Trader was launched, so for now we're going to concentrate on the desktop platform. Here's a view of an FX order ticket:

As you can see there are a variety of ways of entering a variety of order types, and on FX at least market depth information is made available to you. Minimum order size for forex is 5,000 – midi lots I suppose?

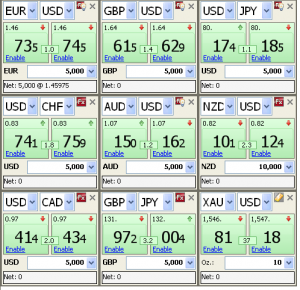

If all that information seems like it's too much to handle, you can look at a table of your favourite instruments instead:

If you click the little "Trade" check box the quotes turn into green buttons, and you can perform a one click trade by just clicking one of them. Note too that "Gold" is available either as spot "FX" or as a futures style CFD complete with expiry date. That no doubt explains why the "Value Date" box which allows you to select a forward date for FX pairs is grayed out for gold. Along with the other commodity CFDs, there is also a "continuous" version of gold of the sort familiar to futures traders. This merges the different contract expiries into a single set of data that can be charted and/or analyzed without any sudden jumps at expiry, but can't be traded.

There you have our first quick impressions of Saxo Bank's new retail brokerage offering. It looks like it's going to be worth a very close look at a practice account if you're happy trading manually and you have in your possession at least $2,000 you're willing to lose. However if you're into automated forex trading like us, or you're from North America, unfortunately you'll need to look elsewhere. As things stand at the moment ForexTrading.com isn't going to see off MetaQuotes.net just yet.

Filed under Brokers by ![]()

Leave a Comment